Metro PCS 2010 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2010, 2009 and 2008

F-30

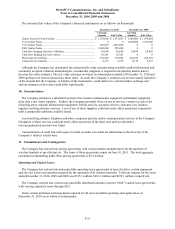

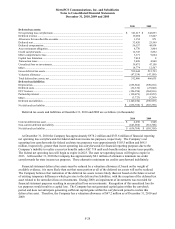

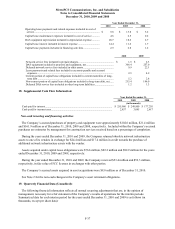

2010 2009 2008

Basic EPS:

Net income applicable to common stoc

k

..................................... $ 193,415 $ 176,844 $ 149,438

Amount allocable to common shareholders ................................. 99.3% 99.6% 100.0%

Rights to undistributed earnings .................................................. $ 192,044 $ 176,160 $ 149,438

Weighted average shares outstanding

—

b

asic............................ 353,711,045 351,898,898 349,395,285

Net income per common share

—

b

asic ...................................... $ 0.54 $ 0.50 $ 0.43

Diluted EPS:

Rights to undistributed earnings .................................................. $ 192,044 $ 176,160 $ 149,438

Weighted average shares outstanding

—

b

asic............................ 353,711,045 351,898,898 349,395,285

Effect of dilutive securities:

Stock options ............................................................................. 2,424,044 4,044,023 5,984,826

Weighted average shares outstanding

—

dilute

d

......................... 356,135,089 355,942,921 355,380,111

Net income per common share

—

dilute

d

................................... $ 0.54 $ 0.49 $ 0.42

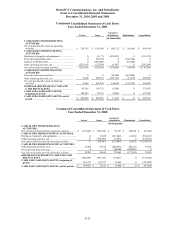

In accordance with ASC 260, unvested share-based payment awards that contain rights to receive non-forfeitable

dividends or dividend equivalents, whether paid or unpaid, are considered a “participating security” for purposes of

computing earnings or loss per common share and the two-class method of computing earnings per share is required

for all periods presented.

Under the restricted stock award agreements, unvested shares of restricted stock have rights to receive non-

forfeitable dividends. For the years ended December 31, 2010 and 2009, the Company has calculated diluted

earnings per share under both the treasury stock method and the two-class method. There was not a significant

difference in the per share amounts calculated under the two methods, and the two-class method is disclosed. There

were no restricted stock awards issued prior to January 1, 2009. For the years ended December 31, 2010 and 2009,

2.6 million and 1.4 million restricted common shares issued to employees have been excluded from the computation

of basic net income per common share since the shares are not vested and remain subject to forfeiture.

For the years ended December 31, 2010, 2009 and 2008, approximately 25.0 million, 15.8 million and 11.9

million, respectively, of stock options were excluded from the calculation of diluted net income per common share

since the effect was anti-dilutive.

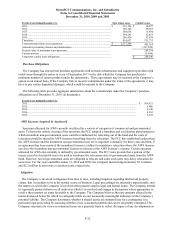

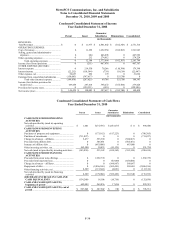

16. Guarantor Subsidiaries:

In connection with Wireless’ 7Ǭ% Senior Notes, 6з% Senior Notes, and the Senior Secured Credit Facility,

MetroPCS, together with its wholly owned subsidiaries, MetroPCS Inc., and Wireless, and each of Wireless’ direct

and indirect present and future wholly-owned domestic subsidiaries (the “guarantor subsidiaries”), provided

guarantees which are full and unconditional as well as joint and several. Certain provisions of the Senior Secured

Credit Facility and the indentures relating to the 7Ǭ% Senior Notes and 6з% Senior Notes restrict the ability of

Wireless to loan funds to MetroPCS. However, Wireless is allowed to make certain permitted payments to

MetroPCS under the terms of the Senior Secured Credit Facility and the indentures.

During the quarter ended December 31, 2010, there was a change to the guarantor structure of the Company’s

debt. Prior to December 2010, Royal Street Communications and MetroPCS Finance (the “non-guarantor

subsidiaries”) were not guarantors of the 9¼% Senior Notes, 7Ǭ% Senior Notes, 6ǫ% Senior Notes or the Senior

Secured Credit Facility. On December 22, 2010, MetroPCS completed the acquisition of the remaining 15% limited

liability company member interest in Royal Street Communications, making Royal Street Communications a

wholly-owned subsidiary. In addition, MetroPCS Finance was dissolved and no longer exists. Therefore, the

Company no longer has any non-guarantors of any of its outstanding debt as of December 31, 2010. As a result, the

comparative historical condensed consolidating financial information has been revised to present this information as

if the new guarantor structure existed for all periods presented with the results of Royal Street Communications and

MetroPCS Finance being reported as guarantor subsidiaries.

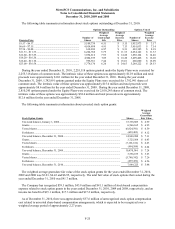

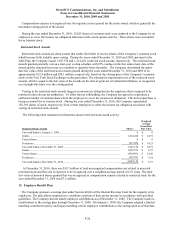

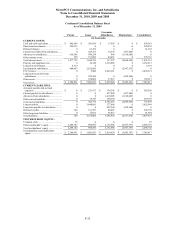

The following information presents condensed consolidating balance sheets as of December 31, 2010 and 2009,