Metro PCS 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

Three Months Ended

March 31,

2009

June 30,

2009

September 30,

2009

December 31,

2009

(In thousands, exce

p

t

g

ross customer additions and CPGA)

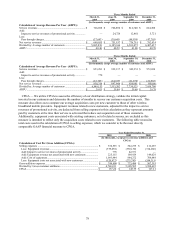

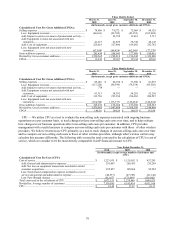

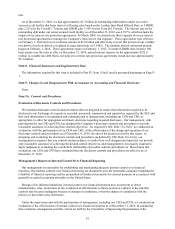

Calculation of Cost Per Gross Addition (CPGA):

Selling expenses ...................................................................... $ 74,906 $ 74,272 $ 72,968 $ 80,129

Less: Equipment revenues .................................................... (68,631) (92,762) (83,253) (105,484)

Add: Impact to service revenues of promotional activity .....

—

24,728 12,481 5,721

Add: Equipment revenue not associated with new

customers ............................................................................ 41,215 41,829 38,742 48,143

Add: Cost of equipment ........................................................ 225,018 227,400 199,092 232,762

Less: Equipment costs not associated with new

customers ............................................................................ (67,058) (69,424) (62,041) (77,270)

Gross addition expenses ........................................................... $ 205,450 $ 206,043 $ 177,989 $ 184,001

Divided by: Gross customer additions ..................................... 1,530,565 1,288,818 1,156,242 1,329,880

CPGA ...................................................................................... $ 134.23 $ 159.87 $ 153.94 $ 138.36

Three Months Ended

March 31,

2010

June 30,

2010

September 30,

2010

December 31,

2010

(In thousands, exce

p

t

g

ross customer additions and CPGA)

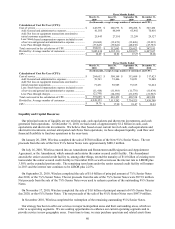

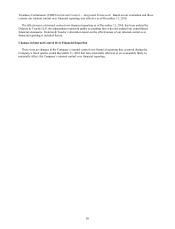

Calculation of Cost Per Gross Addition (CPGA):

Selling expenses ...................................................................... $ 89,146 $ 86,194 $ 73,380 $ 81,872

Less: Equipment revenues .................................................... (117,220) (90,399) (78,538) (93,502)

Add: Impact to service revenues of promotional activity ..... 778

—

—

—

Add: Equipment revenue not associated with new

customers ............................................................................ 63,313 54,392 54,201 53,210

Add: Cost of equipment ........................................................ 313,738 235,354 256,265 288,587

Less: Equipment costs not associated with new

customers ............................................................................ (134,744) (113,377) (128,016) (144,834)

Gross addition expenses ........................................................... $ 215,011 $ 172,164 $ 177,292 $ 185,333

Divided by: Gross customer additions ..................................... 1,470,865 1,047,898 1,104,350 1,144,898

CPGA ...................................................................................... $ 146.18 $ 164.29 $ 160.54 $ 161.88

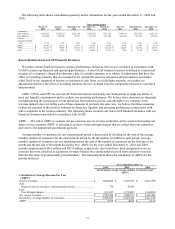

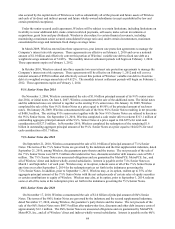

CPU — We utilize CPU as a tool to evaluate the non-selling cash expenses associated with ongoing business

operations on a per customer basis, to track changes in these non-selling cash costs over time, and to help evaluate

how changes in our business operations affect non-selling cash costs per customer. In addition, CPU provides

management with a useful measure to compare our non-selling cash costs per customer with those of other wireless

providers. We believe investors use CPU primarily as a tool to track changes in our non-selling cash costs over time

and to compare our non-selling cash costs to those of other wireless providers, although other wireless carriers may

calculate this measure differently. The following table reconciles total costs used in the calculation of CPU to cost of

service, which we consider to be the most directly comparable GAAP financial measure to CPU.

Year Ended December 31,

2010 2009 2008

(In thousands, except average number of customers and

CPU)

Calculation of Cost Per User (CPU):

Cost of service ........................................................................................ $ 1,223,931 $ 1,120,052 $ 857,295

Add: General and administrative expenses .......................................... 291,067 265,455 235,289

Add: Net loss on equipment transactions unrelated to initial

customer acquisition ............................................................................ 295,857 105,864 95,282

Less: Stoc

k

-

b

ased compensation expense included in cost of

service and general and administrative expense .................................. (46,537) (47,783) (41,142)

Less: Pass through charges .................................................................. (91,167) (173,099) (136,801)

Total costs used in the calculation of CPU ............................................. $ 1,673,151 $ 1,270,489 $ 1,009,923

Divided by: Average number of customers ............................................ 7,538,895 6,145,414 4,631,168

CPU ........................................................................................................ $ 18.49 $ 17.23 $ 18.17