Metro PCS 2010 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2010, 2009 and 2008

F-20

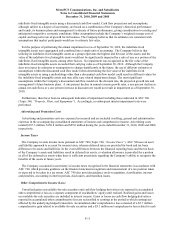

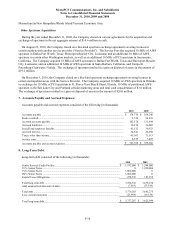

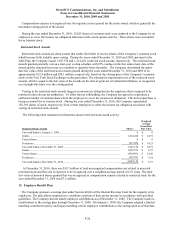

The following table summarizes assets and liabilities measured at fair value on a recurring basis at December 31,

2009, as required by ASC 820 (in thousands):

Fair Value Measurements

Level 1 Level 2 Level 3 Total

Assets

Cash equivalents ........................................................................... $ 910,034 $ 0 $ 0 $ 910,034

Short-term investments ................................................................. 224,932 0 0 224,932

Restricted cash and investments .................................................... 15,438 0 0 15,438

Long-term investments ................................................................. 0 0 6,319 6,319

Total assets measured at fair value ...................................................... $1,150,404 $ 0 $ 6,319 $1,156,723

Liabilities

Derivative liabilities ...................................................................... $ 0 $ 24,859 $ 0 $ 24,859

Total liabilities measured at fair value ................................................. $ 0 $ 24,859 $ 0 $ 24,859

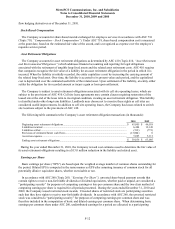

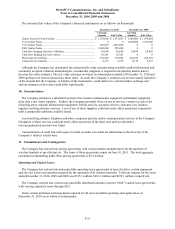

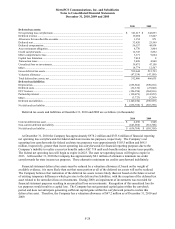

The following table summarizes the changes in fair value of the Company’s net derivative liabilities included in

Level 2 assets (in thousands):

Fair Value Measurements of Net Derivative Liabilities Using Level 2 Inputs Net Derivative Liabilities

2010 2009

Beginning balance .......................................................................................................

.

$ 24,859 $ 54,963

Total losses (realized or unrealized):

Included in earnings (1) ......................................................................................

.

28,696 54,334

Included in accumulated other comprehensive loss............................................

.

(12,146) (24,230)

Transfers in and/or out of Level 2 ......................................................................

.

0 0

Purchases, sales, issuances and settlements ........................................................

.

0 0

Ending balance ............................................................................................................

.

$ 8,309 $ 24,859

_________________

(1) Losses included in earnings that are attributable to the reclassification of the effective portion of those derivative liabilities still held at the

reporting date as reported in interest expense in the consolidated statements of income and comprehensive income.

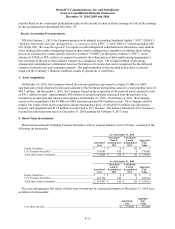

The following table summarizes the changes in fair value of the Company’s Level 3 assets (in thousands):

Fair Value Measurements of Assets Using Level 3 Inputs Long-Term Investments

2010 2009

Beginning balance .........................................................................................................

.

$ 6,319 $ 5,986

Total losses (realized or unrealized):

Included in earnings (2) ........................................................................................

.

0 2,386

Included in accumulated other comprehensive loss..............................................

.

0 (2,719)

Transfers in and/or out of Level 3 ........................................................................

.

0 0

Purchases, sales, issuances and settlements ..........................................................

.

0 0

Ending balance ..............................................................................................................

.

$ 6,319 $ 6,319

_________________

(2) Losses included in earnings that are attributable to the change in unrealized losses relating to those assets still held at the reporting date as

reported in impairment loss on investment securities in the consolidated statements of income and comprehensive income.

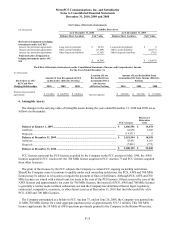

The fair value of the Company’s long-term debt is estimated based on the quoted market prices for the same or

similar issues or on the current rates offered to the Company for debt of the same remaining maturities.