Metro PCS 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 85

Senior Notes on May 15 and November 15 of each year. Wireless may, at its option, redeem some or all of the

6з% Senior Notes at any time on or after November 15, 2015 for the redemption prices set forth in the indentures

governing the 6з% Senior Notes. In addition, prior to November 15, 2013, Wireless may, at its option, redeem up to

35% of the aggregate principal amount of the 6з% Senior Notes with the net cash proceeds of certain sales of equity

securities or certain contributions to equity of Wireless. Wireless may also, at its option, prior to November 15,

2015, redeem some or all of the notes at the redemption price set forth in the indentures governing the 6з% Senior

Notes.

Capital Lease Obligations

We have entered into various non-cancelable capital lease agreements, with expirations through 2025. Assets and

future obligations related to capital leases are included in the accompanying consolidated balance sheets in property

and equipment and long-term debt, respectively. Depreciation of assets held under capital lease obligations is

included in depreciation and amortization expense.

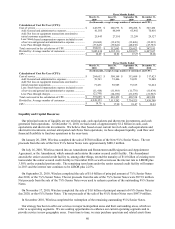

Capital Expenditures and Other Asset Acquisitions and Dispositions

Capital Expenditures. We currently expect to incur capital expenditures in the range of $650.0 million to $800.0

million on a consolidated basis for the year ending December 31, 2011.

During the year ended December 31, 2010, we incurred approximately $790.4 million in capital expenditures.

These capital expenditures were primarily associated with our efforts to increase the service area and capacity of our

existing network and the upgrade of our network to 4G LTE in select metropolitan areas.

During the year ended December 31, 2009, we incurred approximately $831.7 million in capital expenditures.

These capital expenditures were primarily for the expansion and improvement of our existing network infrastructure

and costs associated with the construction of new markets.

During the year ended December 31, 2008, we incurred $954.6 million in capital expenditures. These capital

expenditures were primarily for the expansion and improvement of our existing network infrastructure and costs

associated with the construction of new markets.

Other Acquisitions and Dispositions. On June 26, 2008, we were granted one 12 MHz 700 MHz license for a

total purchase price of approximately $313.3 million. This 700 MHz license supplements the 10 MHz of AWS

spectrum previously granted to us in the Boston-Worcester, Massachusetts/New Hampshire/Rhode Island/Vermont

Economic Area as a result of FCC Auction 66.

During the years ended December 31, 2009 and 2008, we closed on various agreements for the acquisition and

exchange of spectrum in the net aggregate amount of approximately $14.6 million and $21.8 million in cash,

respectively.

During the year ended December 31, 2009, we received $52.3 million in fair value of FCC licenses in exchanges

with other parties.

On August 23, 2010, we closed on a like-kind spectrum exchange agreement covering licenses in certain markets

with a service provider, or Service Provider. The Service Provider acquired 10 MHz of AWS spectrum in

Dallas/Fort Worth, Texas; Shreveport-Bossier City, Louisiana; and an additional 10 MHz of AWS spectrum in

certain other Washington markets, as well as an additional 10 MHz of PCS spectrum in Sacramento, California. We

acquired an additional 10 MHz of AWS spectrum in Santa Barbara, California; Tampa-St. Petersburg-Clearwater,

Florida; and 10MHz of AWS spectrum in Dallas/Fort Worth, Texas and Shreveport-Bossier City, Louisiana. The

exchange of spectrum resulted in a gain on disposal of assets in the amount of $19.2 million.

On October 14, 2010, we entered into an asset purchase agreement to acquire 10 MHz of AWS spectrum and

certain related network assets adjacent to the Northeast metropolitan areas and surrounding areas for a total purchase

price of $49.5 million. On November 1, 2010, we closed on the acquisition of the network assets and paid a total of

$41.1 million in cash. On February 4, 2011, we closed on the acquisition of the 10 MHz of AWS spectrum and paid

$8.0 million in cash.