Metro PCS 2010 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2010, 2009 and 2008

F-34

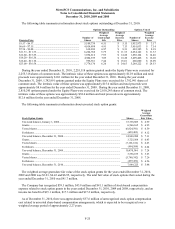

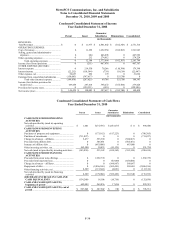

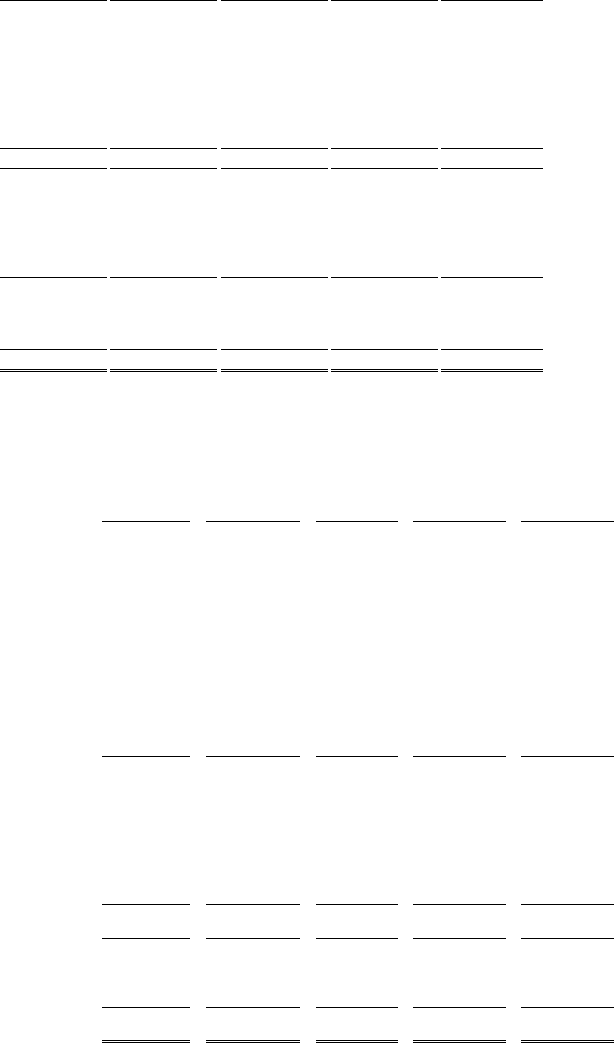

Consolidated Statement of Income

Year Ended December 31, 2008

Parent Issuer

Guarantor

Subsidiaries Eliminations Consolidated

(in thousands)

REVENUES:

Total Revenues .............................................. $ 0 $ 11,977 $ 2,841,842 $ (102,303) $ 2,751,516

OPERATING EXPENSES:

Cost of revenues ............................................ 0 11,292 1,652,954 (102,303) 1,561,943

Selling, general and administrative

expenses ...................................................... 0 684 446,898 0 447,582

Other operating expenses .............................. 0212 274,012 0 274,224

Total operating expenses ..................... 0 12,188 2,373,864 (102,303) 2,283,749

Income (loss) from operations ...................... 0 (211) 467,978 0 467,767

OTHER EXPENSE (INCOME):

Interest expense ............................................. 0 219,530 70,266 (110,398) 179,398

Interest income .............................................. (22,212) (110,394) (739) 110,398 (22,947)

Other expense, net ......................................... 30,857 856 179 0 31,892

Earnings from consolidated subsidiaries ...... (158,083) (397,617) 0555,700 0

Total other (income) expense .............. (149,438) (287,625) 69,706 555,700 188,343

Income (loss) before provision for

income taxes ............................................... 149,438 287,414 398,272 (555,700) 279,424

Provision for income taxes ............................ 0 (129,331) (655) 0 (129,986)

Net income (loss) .......................................... $ 149,438 $ 158,083 $ 397,617 $ (555,700) $ 149,438

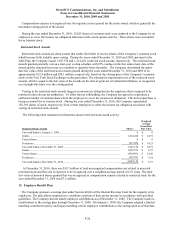

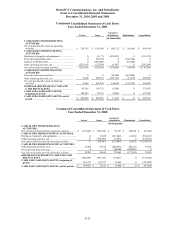

Consolidated Statement of Cash Flows

Year Ended December 31, 2010

Parent Issuer

Guarantor

Subsidiaries Eliminations Consolidated

(in thousands)

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net cash provided by (used in) operating

activities ................................................................... $ 1,401 $(37,976) $1,031,075 $ 0 $ 994,500

CASH FLOWS FROM INVESTING

ACTIVITIES:

Purchases of property and equipment ........................ 0 (173,162) (617,223) 0 (790,385)

Purchase of investments ............................................. (711,827) 0 0 0 (711,827)

Change in advances

–

affiliates .................................. 5,477 555,390 0 (560,867) 0

Proceeds from affiliate deb

t

....................................... 0 505,481 0 (505,481) 0

Issuance of affiliate deb

t

............................................ 0 (683,000) 0 683,000 0

Other investing activities, ne

t

..................................... 562,500 30,433 (41,139) 0 551,794

Net cash (used in) provided by investing activities ... (143,850) 235,142 (658,362) (383,348) (950,418)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Proceeds from senior note offerings .......................... 0 1,992,770 0 0 1,992,770

Proceeds from long-term loan .................................... 0 0 683,000 (683,000) 0

Change in advances

–

affiliates .................................. 0 0 (560,867) 560,867 0

Repayment of deb

t

...................................................... 0 (2,056,186) (505,481) 505,481 (2,056,186)

Other financing activities, ne

t

.................................... 8,209 (115,644) (6,081) 0 (113,516)

Net cash provided by (used in) financing

activities ................................................................... 8,209 (179,060) (389,429) 383,348 (176,932)

(DECREASE) INCREASE IN CASH AND

CASH EQUIVALENTS ........................................ (134,240) 18,106 (16,716) 0 (132,850)

CASH AND CASH EQUIVALENTS,

be

g

innin

g

of

p

eriod ................................................ 642,089 269,836 17,456 0 929,381

CASH AND CASH EQUIVALENTS, end of

p

eriod ....................................................................... $ 507,849 $ 287,942 $ 740 $ 0 $ 796,531

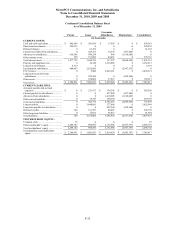

Condensed

Condensed