Metro PCS 2010 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2010, 2009 and 2008

F-15

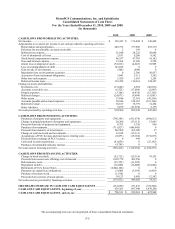

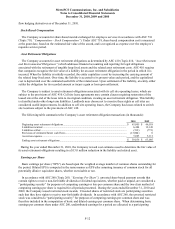

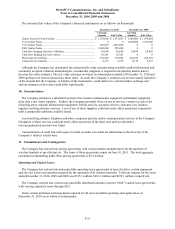

Fair Values of Derivative Instruments

(in thousands) Liability Derivatives

As of December 31, 2010 As of December 31, 2009

Balance Sheet Location Fair Value Balance Sheet Location Fair Value

Derivatives designated as hedging

instruments under ASC 815

Interest rate protection agreements Long-term investments $ 10,381 Long-term investments $ 0

Interest rate protection agreements Other current liabilities (17,508) Other current liabilities (24,157)

Interest rate protection agreements Other long-term liabilities (1,182) Other long-term liabilities (702)

Total derivatives designated as

hedging instruments under ASC

815

$ (8,309)

$ (24,859)

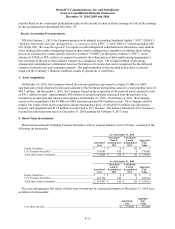

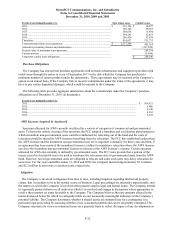

The Effect of Derivative Instruments on the Consolidated Statement of Income and Comprehensive Income

For the Years Ended December 31,

(in thousands)

Derivatives in ASC

815 Cash Flow

Hedging Relationships

Amount of Loss Recognized in OCI

on Derivative (Effective Portion)

Location of Loss

Reclassified from

Accumulated OCI

into Income

(Effective Portion)

Amount of Loss Reclassified from

Accumulated OCI into Income (Effective

Portion)

2010 2009 2008 2010 2009 2008

Interest rate protection

agreements

$ (12,146) $ (24,230) $ (50,866) Interest expense $ (28,696) $ (54,334) $ (19,406)

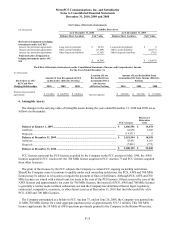

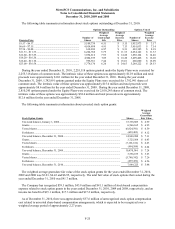

6. Intangible Assets:

The changes in the carrying value of intangible assets during the years ended December 31, 2010 and 2009 are as

follows (in thousands):

FCC Licenses

Microwave

Relocation

Costs

Balance at Januar

y

1, 2009 .............................................................................................. $ 2,406,596 $ 16,478

Additions ............................................................................................................................ 64,879 2,160

Disposals ............................................................................................................................ (19,931) 0

Balance at December 31, 2009 ......................................................................................... $ 2,451,544 $ 18,638

Additions ............................................................................................................................ 56,451 4,183

Disposals ............................................................................................................................ (7,803) (772)

Balance at December 31, 2010 ......................................................................................... $ 2,500,192 $ 22,049

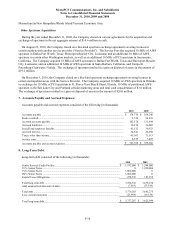

FCC licenses represent the PCS licenses acquired by the Company in the FCC auction in May 1996, the AWS

licenses acquired in FCC Auction 66, the 700 MHz license acquired in FCC Auction 73 and FCC licenses acquired

from other licensees.

The grant of the licenses by the FCC subjects the Company to certain FCC ongoing ownership restrictions.

Should the Company cease to continue to qualify under such ownership restrictions, the PCS, AWS and 700 MHz

licenses may be subject to revocation or require the payment of fines or forfeitures. Although PCS, AWS and 700

MHz licenses are issued with a stated term, ten years in the case of the PCS licenses, fifteen years in the case of the

AWS licenses and approximately ten years for 700 MHz licenses, the renewal of PCS, AWS and 700 MHz licenses

is generally a routine matter without substantial cost and the Company has determined that no legal, regulatory,

contractual, competitive, economic, or other factors exist as of December 31, 2010 that limit the useful life of its

PCS, AWS and 700 MHz licenses.

The Company participated as a bidder in FCC Auction 73, and on June 26, 2008, the Company was granted one

12 MHz 700 MHz license for a total aggregate purchase price of approximately $313.3 million. This 700 MHz

license supplements the 10 MHz of AWS spectrum previously granted to the Company in the Boston-Worcester,