Metro PCS 2010 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2010, 2009 and 2008

F-13

security based on the contractual participation rights of the security to share in those earnings as if all of the earnings

for the period had been distributed (See Note 15).

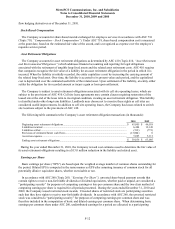

Recent Accounting Pronouncements

Effective January 1, 2011, the Company prospectively adopted Accounting Standards Update (“ASU”) 2009-13,

“Multiple Deliverable Revenue Arrangements – a consensus of the EITF, “ (“ASU 2009-13”) which amended ASC

605 (Topic 605, “Revenue Recognition”) to require overall arrangement consideration be allocated to each element

in the multiple deliverable arrangement based on their relative selling prices, regardless of whether those selling

prices are evidenced by vendor-specific objective evidence (“VSOE”) or third party evidence (“TPE”). In the

absence of VSOE or TPE, entities are required to estimate the selling prices of deliverables using management’s

best estimates of the prices that would be charged on a standalone basis. The residual method of allocating

arrangement consideration is eliminated; however the balance of revenue that can be recognized for the delivered

element is limited to the non-contingent amount. The implementation of this standard did not have a material

impact on the Company’s financial condition, results of operations or cash flows.

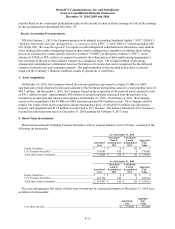

3. Asset Acquisition:

On October 14, 2010, the Company entered into an asset purchase agreement to acquire 10 MHz of AWS

spectrum and certain related network assets adjacent to the Northeast metropolitan areas for a total purchase price of

$49.5 million. On November 1, 2010, the Company closed on the acquisition of the network assets and paid a total

of $41.1 million in cash. Approximately $0.4 million of accrued expenses associated with the purchase were

included in accounts payable and accrued expenses at December 31, 2010. On February 4, 2011, the Company

closed on the acquisition of the 10 MHz of AWS spectrum and paid $8.0 million in cash. The Company used the

relative fair values of the assets acquired to allocate the purchase price, of which $35.6 million was allocated to

property and equipment and $13.9 million was allocated to FCC licenses. The balance allocated to FCC licenses is

recorded in other long-term assets December 31, 2010 pending the February 4, 2011 close.

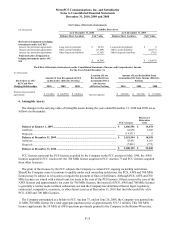

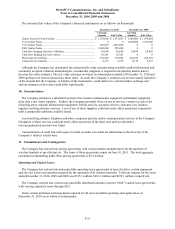

4. Short-Term Investments:

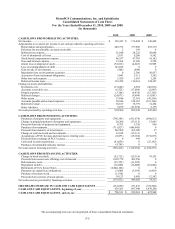

Short-term investments including Treasury Securities, with an original maturity of over 90 days, consisted of the

following (in thousands):

As of December 31, 2010

Amortized

Cost

Unrealized

Gain in

Accumulated

OCI

Unrealized

Loss in

Accumulated

OCI

Aggregate

Fair

Value

Equity Securities .........................................................................

.

$ 7 $ 0 $ (6) $ 1

U.S. Treasury Securities .............................................................

.

374,681 180 0 374,861

Total short-term investments ......................................................

.

$ 374,688 $ 180 $ (6) $ 374,862

As of December 31, 2009

Amortized

Cost

Unrealized

Gain in

Accumulated

OCI

Unrealized

Loss in

Accumulated

OCI

Aggregate

Fair

Value

Equity Securities .........................................................................

.

$ 7 $ 0 $ (5) $ 2

U.S. Treasury Securities .............................................................

.

224,790 140 0 224,930

Total short-term investments ......................................................

.

$ 224,797 $ 140 $ (5) $ 224,932

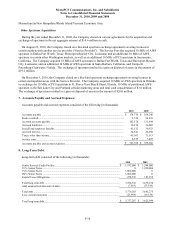

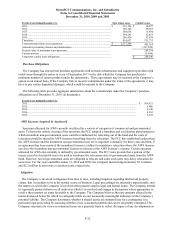

The cost and aggregate fair values of short-term investments by contractual maturity at December 31, 2010 were

as follows (in thousands):

Amortized

Cost

Aggregate

Fair

Value

Less than one yea

r

............................................................................................................... $ 374,681 $ 374,861

at