Metro PCS 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

simple, straightforward service plan that is lower priced, includes all applicable taxes and regulatory fees, and has

features comparable to those of a traditional post-paid provider.

Throughout 2010, the customer response to Wireless for All was overwhelmingly positive and exceeded our

expectations with the addition of more than 1.5 million net subscriber additions - a record year for the Company. As

an industry, prepaid continued to gain share throughout 2010 with an estimated 53% of 2010 industry gross

additions. More importantly, subscribers benefitting from the Wireless for All evolution recognized the enhanced

handset and Smartphone line-up as an opportunity to upgrade to an expanding portfolio of Android, QWERTY and

touch-screen phones. With this expanded choice, approximately half of our subscribers upgraded their handsets

during the year.

Financial Health

A foundational premise of our business is to deliver tremendous value while managing and maintaining a low cost

structure. We believe we are uniquely positioned now and in the future to potentially deliver accelerated free cash

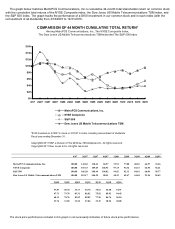

flow as we add customers to our state-of-the-art 4G LTE network. In 2010, we continued our profitable growth and for

the year, service revenue grew 18% to $3.7 billion, consolidated Adjusted EBITDA increased 23% to $1.18 billion and

operating income grew 34% to $719 million1. Furthermore, we generated unlevered free cash flow (Adjusted EBITDA

less Capital Expenditures) of $386 million.

Our company made a number of important and strategic decisions throughout the year that significantly enhanced

our balance sheet. We retired our 9 1/4% Senior Notes due 2014 with the completion of two successful bond

offerings which include the issuance of $1 billion of 7 7/8% Senior Notes due 2018 and the issuance of $1 billion of 6

5/8% Senior Notes due 2020. This refinancing coupled with the $1 billion amendment and extension of our Senior

Secured Credit Facility completed in the summer of 2010 signified key steps in extending and staggering the maturity

schedule of our capital structure. Consistent with our low-cost operating strategy, with the lower rates, we expect to

recognize significant interest expense savings in the future.

Operationally, we grew the business at record levels while actively managing our Cost Per Gross Addition (CPGA)

and Cost Per User (CPU). In 2010, we reported a consolidated CPGA of $157 which is roughly less than half the

average CPGA of the national postpaid wireless carriers. During 2010, CPU was pressured by the continued build

out of our 4G LTE network, handset upgrades for approximately 50% of our subscriber base and the implementation

of the Wireless for All service plans. Even with these additional costs, CPU for the full year 2010 was approximately

$18, which is considerably less than the national wireless providers.

The wireless industry has and continues to be a competitive space; however, the challenges presented will not

obscure the opportunities we see in the future. We believe the no-contract segment is reaching a new phase in its

development as the business expands maximizing the use of our 4G LTE network. We believe we will see

tremendous opportunity from Smartphones with increased functionality as a personal entertainment device.

Importantly, we believe the cost of these Smartphones will decrease over time once volumes and availability increase

throughout the industry. It is clear to us that our customers want feature-rich and affordable multimedia Smartphones.

We are excited from the impact of Android devices, which are becoming a staple commodity across the handset

ecosystem. We believe these dynamics position MetroPCS for continued innovation and growth.

4G LTE

The Internet is going mobile and consumer demands for multimedia and video entertainment on their wireless

devices is increasing at a rapid rate. Foreseeing this shift years ago, we decided to pursue a strategy in which we

would transform our network to 4G LTE -- the platform for today, and the foundation for the future of MetroPCS. Our

strategy became a commercial reality in September of 2010 when we became the first U.S. mobile operator to launch

commercial 4G LTE service in the United States. And as I said at the time, it was and is a “giant step for our

business.” We believe 4G LTE is a transformative technology ushering in a sea change for overall network efficiency

and overall economics to support the ever increasing demands for video and data.

1 2010 Operating Income includes gains of $46 million recognized on FCC license exchanges consummated during the year. On a

non-GAAP basis excluding these gains, operating income would have been $673 million.