Metro PCS 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

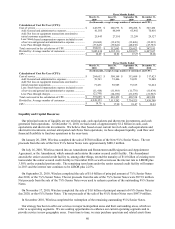

Cost of Service. Cost of service increased approximately $262.8 million, or approximately 31%, to $1.1 billion

for the year ended December 31, 2009 from approximately $857.3 million for the year ended December 31, 2008.

The increase in cost of service is primarily attributable to an approximate 24% growth in our customer base and the

deployment of additional network infrastructure during the twelve months ended December 31, 2009 and costs

associated with our unlimited international calling product.

Cost of Equipment. Cost of equipment increased $179.6 million, or approximately 26%, to approximately $884.3

million for the year ended December 31, 2009 from approximately $704.7 million for the year ended December 31,

2008. The increase in cost of equipment is primarily attributable to an increase in gross customer additions

accounting for an approximately $145.5 million increase as well as higher upgrade handset costs to existing

customers which led to an approximate $57.5 million increase. These increases were partially offset by the sale of

lower priced handsets accounting for an approximate $30.0 million decrease in cost of equipment.

Selling, General and Administrative Expenses. Selling, general and administrative expenses increased $120.1

million, or approximately 27%, to $567.7 million for the year ended December 31, 2009 from approximately $447.6

million for the year ended December 31, 2008. Selling expenses increased by approximately $90.0 million for the

year ended December 31, 2009 compared to the year ended December 31, 2008. The increase in selling expenses is

primarily attributable to an approximate $50.1 million increase in marketing and advertising expenses, an

approximate $24.5 million increase in employee related costs and a $6.4 million increase in MetroFLASH®

expense. General and administrative expenses increased $24.8 million for the year ended December 31, 2009 as

compared to the year ended December 31, 2008 primarily due to the growth in our business.

Depreciation and Amortization. Depreciation and amortization expense increased approximately $122.5 million,

or 48%, to $377.8 million for the year ended December 31, 2009 from $255.3 million for the year ended December

31, 2008. The increase is related primarily to network infrastructure assets that were placed into service during the

twelve months ended December 31, 2009 to support the continued growth and expansion of our network.

(Gain) loss on Disposal of Assets. Gain on disposal of assets increased approximately $23.6 million, or

approximately 125%, to approximately $4.7 million for the year ended December 31, 2009 from a loss on disposal

of assets of $18.9 million for the year ended December 31, 2008. The gain recognized during the year ended

December 31, 2009 was due primarily to asset sales and FCC license exchanges consummated during the year,

partially offset by the disposal of assets related to certain network technology that was retired and replaced with

newer technology during the year ended December 31, 2009. The loss on disposal of assets for the year ended

December 31, 2008 related to certain network equipment and construction costs that were retired.

Non-Operating Items

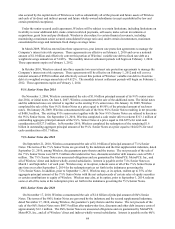

2009 2008 Change

(in thousands)

Interest expense ...........................................................................................................................

.

$ 270,285 $ 179,398 51%

Interest income ............................................................................................................................

.

(2,870) (22,947) (87)%

Impairment loss on investment securities ....................................................................................

.

2,386 30,857 (92)%

Provision for income taxes...........................................................................................................

.

86,835 129,986 (33)%

Net income ...................................................................................................................................

.

176,844 149,438 18%

Interest Expense. Interest expense increased approximately $90.9 million, or approximately 51%, to

approximately $270.3 million for the year ended December 31, 2009 from approximately $179.4 million for the year

ended December 31, 2008. The increase in interest expense was primarily due to an additional $550.0 million of

9¼% senior notes due 2014, or New 9¼% Senior Notes, that were issued in January 2009 and interest on capital

lease obligations that were placed into service during the year ended December 31, 2009 as well as a decrease in

capitalized interest expense. In addition, our weighted average interest rate increased to 8.23% for the year ended

December 31, 2009 compared to 7.78% for the year ended December 31, 2008, which includes the impact of our

interest rate protection agreements. Average debt outstanding for the year ended December 31, 2009 and 2008 was

$3.5 billion and $3.0 billion, respectively.