LensCrafters 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274

|

|

| 7 >MANAGEMENT REPORT

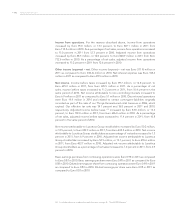

December 31, 2011 decreased further, falling to Euro 2,032 million (Euro 2,111 million at the

end of 2010), and the ratio of net debt to adjusted EBITDA (9) was 1.7x, as compared with

the 2.0x at the end of 2010. For 2012, a further decrease in financial leverage is expected.

January

On January 20, 2011, the Group terminated the revolving credit line with Banca Nazionale

del Lavoro totaling Euro 150 million. The original maturity date of the credit line was July

13, 2011.

February

On February 17, 2011, the Group announced that it had entered into agreements pursuant

to which the Group subsequently acquired two sunglass specialty retail chains totaling

more than 70 stores in Mexico for a total amount of Euro 19.5 million. This transaction

marked the Company’s entry into the sun retail business in Mexico where the Group already

had a solid presence through its Wholesale division. The acquisition was completed in the

second quarter of 2011. All the acquired stores were rebranded to under the Sunglass Hut

brand during 2011.

March

During the first three-months of 2011, we purchased on the Mercato Telematico Azionario

(“MTA”) 466,204 of our ordinary shares at an average price of Euro 22.45 per share, for a

total amount of Euro 10.5 million, pursuant to the stock purchase program approved at

the Stockholders’ Meeting on October 29, 2009 and launched on November 16, 2009. This

stock purchase program expired on April 28, 2011.

April

At the Stockholders’ Meeting on April 28, 2011, the stockholders approved the Statutory

Financial Statements as of December 31, 2010, as proposed by the Board of Directors and

the distribution of a cash dividend of Euro 0.44 per ordinary share, reflecting a 26 percent

year-over-year increase. The aggregate dividend amount of Euro 202.5 million was fully

paid in May 2011.

May

On May 23, 2011, the Group announced that it had entered into an agreement to accelerate

the purchases, in 2011, of 60 percent of Multiopticas Internacional S.L. (Multiopticas

Internacional”) share capital. The Group already owned a 40 percent stake in Multiopticas

Internacional, which itself owned over 470 eyewear stores operating under the Opticas

GMO, Econopticas and Sun Planet retail brands in Chile, Peru, Ecuador and Colombia.

Following the exercise of the call option (which was worth approximately Euro 95 million),

the Group’s ownership increased to 100 percent of Multiopticas Internacional’s share

capital.

(9) For a further discussion of net debt and the ratio of net debt to adjusted EBITDA, see page 43 – “Non-IAS/IFRS Measures.

2. SIGNIFICANT

EVENTS DURING

2011