LensCrafters 2011 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2011 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274

|

|

ANNUAL REPORT 2011> 146 |

The recoverable amount of cash-generating units has been determined by utilizing post-

tax cash flow forecasts based on the three-year plan for the 2012-2014 period, prepared by

management on the basis of the results attained in previous years as well as management

expectations – split by geographical area – on future trends in the eyewear market for both

the Wholesale and Retail distribution segments. At the end of the cash flow forecasting

period, a terminal value was estimated in order to reflect the value of the cash-generating

unit after the period of the plan. The terminal values were calculated as a perpetuity at

the same growth rate as described above and represent the present value, in the last year

of the forecast, of all future perpetual cash flows. In particular, it should be noted that, in

accordance with the provisions of paragraph 71 of IAS 36, future cash flows of the cash-

generating units in the Retail distribution segment were adjusted in order to reflect the

transfer prices at market conditions. This adjustment was made since the cash generating

units belonging to this segment generate distinct and independent cash flows whose

products are sold within an active market. The impairment test performed as of the balance

sheet date resulted in a recoverable value greater than the carrying amount (net operating

assets) of the abovementioned cash-generating units. No external impairment indicators

were identified which could highlight potential risks of impairment. In percentage terms,

the surplus of the recoverable amount of the cash-generating unit over its carrying amount

was equal to 164 percent and 218 percent of the carrying amount of the Wholesale and

Retail North America cash-generating units, respectively. It should be noted that (i) the

discount rate which makes the recoverable amount of the cash-generating units equal to

their carrying amount is approximately 17 percent for Wholesale and 20 percent for Retail

North America, and (ii) the growth rate which makes the recoverable amount of the cash-

generating units equal to their carrying amounts would be negative.

In addition, any reasonable changes to the abovementioned assumptions used to

determine the recoverable amount (i.e. growth rate changes of +/– 1 percent and

discount rate changes of +/– 0.5 percent) would not significantly affect the impairment

test results.

Investments amounted to Euro 8.8 million (Euro 54.1 million as of December 31, 2010).

As described in note 4 “Business Combinations”, the decrease in 2011 as compared to

2010 is mainly related to the acquisition of the remaining 60 percent interest in MOI. As

a result of the acquisition MOI became a fully controlled subsidiary of the Company and,

therefore, has been consolidated line by line starting from the acquisition date. In 2010

MOI was an associate and, therefore, consolidated using the equity method.

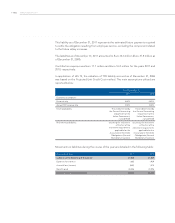

As of December 31

(thousands of Euro) 2011 2010

Other financial assets 50,374 34,014

Other assets 97,251 114,111

Total other non-current assets 147,625 148,125

12. INVESTMENTS

13. OTHER

NON-CURRENT

ASSETS