LensCrafters 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2011> 6 |

As a consequence of the positive growth enjoyed throughout all quarters of the year,

total net sales for 2011 exceeded Euro 6.2 billion, an unprecedented result for Luxottica,

as compared to the previous record of Euro 5.8 billion in 2010 (+7.3 percent at current

exchange rates and 9.9 percent at constant exchange rates (1)).

The year’s operating performance once again confirmed the success of Luxottica’s

strategy of increasing profitability. Operating income increased 13.3 percent to Euro 807.1

million in 2011 from Euro 712.2 million in 2010. Adjusted EBITDA (2) for the full year grew

significantly (+9.8 percent compared to 2010) totaling Euro 1,135.9 million. The adjusted

EBITDA margin (3) increased from the 17.8 percent recorded for 2010 to 18.3 percent in

2011. In the fourth quarter of 2011, adjusted EBITDA (2) showed a 16.6 percent increase

from the same period of the previous year, to Euro 224.7 million, with an adjusted EBITDA

margin (3) of 14.9 percent (14.3 percent in the fourth quarter of 2010).

Growth in adjusted operating income (4) for 2011, amounting to Euro 820.9 million, up 12

percent from the figure recorded at the end of 2010. The Group’s adjusted operating

margin (5) therefore increased from 12.6 percent for 2010 to 13.2 percent for 2011. In the

fourth quarter of the year, adjusted operating income (4) was Euro 139.3 million as compared

with Euro 116.6 million recorded for the same period of the previous year (+19.5 percent),

with an adjusted operating margin (5) up from 8.7 percent to 9.2 percent, thus confirming

the effectiveness of the measures taken to improve profitability.

Operating income of the Wholesale Division in 2011 amounted to Euro 529.1 million (+14.6

percent over 2010), with an operating margin of 21.5 percent (+80 bps as compared with

the previous year).

In 2011, the Retail Division recorded operating income of Euro 436.9 million an increase

over 2010 of Euro 12.5 million. Adjusted operating income (4), of Euro 448.7 million, up 5.7

percent from 2010, with an adjusted operating margin (5) of 11.9 percent, in line with the

previous year.

Net income attributable to Luxottica Stockholders for the year amounted to Euro 452.3

million, up 7.3 percent from Euro 402.2 million for 2010, corresponding to an Earnings

per Share (EPS) of Euro 0.98. Adjusted net income attributable to Luxottica Group

Stockholders (6) for the year amounted to Euro 455.6 million, up 13.1 percent from

Euro 402.7 million for 2010, corresponding to adjusted Earnings per Share (EPS) (7) of

Euro 0.99. In the fourth quarter of 2011, adjusted net income attributable to Luxottica

Group Stockholders (6) went from Euro 55.6 million to Euro 72.7 million (+30.8 percent).

By carefully controlling working capital, the Group generated strong free cash flow (8),

reaching approximately Euro 500 million during the year. As a result, net debt as of

(1) We calculate constant exchange rates by applying to the current period the average exchange rates between the Euro and the relevant

currencies of the various markets in which we operated during the year ended December 31, 2011. Please refer to the attachment to the notes

to the consolidated nancial statements as of December 31, 2011, for further details on exchange rates.

(2) For a further discussion of adjusted EBITDA, see page 43 – “Non-IAS/IFRS Measures”.

(3) For a further discussion of adjusted EBITDA margin, see page 43 – “Non-IAS/IFRS Measures”.

(4) For a further discussion of adjusted income from operations, see page 43 – “Non-IAS/IFRS Measures”.

(5) For a further discussion of adjusted operating margin, see page 43 – “Non-IAS/IFRS Measures”.

(6) For a further discussion of adjusted net income attributable to Luxottica Group Stockholders, see page 43 – “Non-IAS/IFRS Measures”.

(7) For a further discussion of adjusted EPS, see page 43 – “Non-IAS/IFRS Measures”.

(8) For a further discussion of free cash ow, see page 43 – “Non-IAS/IFRS Measures”.

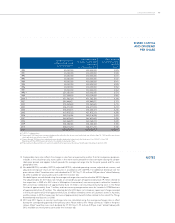

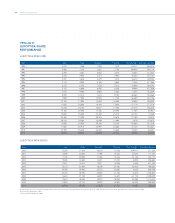

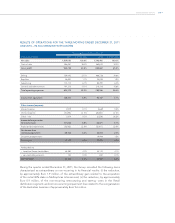

1. OPERATING

PERFORMANCE

FOR THREE-MONTHS

AND YEAR ENDED

DECEMBER 31, 2011