LensCrafters 2011 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2011 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

| 153 >CONSOLIDATED FINANCIAL STATEMENTS - NOTES

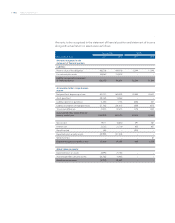

The term loan facility is a term loan of US$ 1.5 billion, with a five-year term, with options

to extend the maturity on two occasions for one year each time. The term loan facility

is divided into two facilities, Facility D and Facility E. Facility D is a US$ 1.0 billion

amortizing term loan requiring repayments of US$ 50 million on a quarterly basis

starting from October 2009, made available to US Holdings, and Facility E consists

of a bullet term loan in an aggregate amount of US$ 500 million, made available to

the Company. Interest accrues on the term loan at LIBOR plus 20 to 40 basis points

based on “Net Debt/EBITDA” ratio, as defined in the facility agreement (0.644 percent

for Facility D and 0.794 percent for Facility E on December 31, 2010). In September

2008, the Company exercised an option included in the agreement to extend the

maturity date of Facilities D and E to October 12, 2013. These credit facilities contain

certain financial and operating covenants. The Company was in compliance with those

covenants as of December 31, 2011. US$ 1.0 billion was borrowed under this credit

facility as of December 31, 2011.

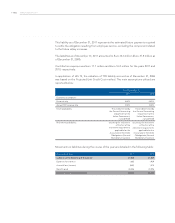

During the third quarter of 2007, the Group entered into ten interest rate swap

transactions with an aggregate initial notional amount of US$ 500 million with various

banks (“Tranche E Swaps”). These swaps will expire on October 12, 2012. The Tranche

E Swaps were entered into as a cash flow hedge on Facility E of the credit facility

discussed above. The Tranche E Swaps exchange the floating rate of LIBOR for an

average fixed rate of 4.26 percent per annum. The ineffectiveness of cash flow hedges

was tested at the inception date and at least every three months. The results of the

tests indicated that the cash flow hedges are highly effective. As a consequence,

approximately US$ (9.8) million, net of taxes, is included in other comprehensive income

as of December 31, 2011. Based on current interest rates and market conditions, the

estimated aggregate amount to be recognized in earnings from other comprehensive

income for these cash flow hedges in fiscal year 2012 is approximately US$ (9.3) million,

net of taxes.

During the fourth quarter of 2008 and the first quarter of 2009, US Holdings entered

into 14 interest rate swap transactions with an aggregate initial notional amount of

US$ 700 million with various banks (“Tranche D Swaps”), which will start to decrease

by US$ 50 million every three months beginning on April 12, 2011. The final maturity

of these swaps will be October 12, 2012. The Tranche D Swaps were entered into as

a cash flow hedge on Facility D of the credit facility discussed above. The Tranche D

Swaps exchange the floating rate of LIBOR for an average fixed rate of 2.672 percent

per annum. The ineffectiveness of cash flow hedges was tested at the inception date

and at least every three months. The results of the tests indicated that the cash flow

hedges are highly effective.

As a consequence, approximately US $(4.8) million, net of taxes, is included in other

comprehensive income as of December 31, 2011. Based on current interest rates and

market conditions, the estimated aggregate amount to be recognized in earnings

from other comprehensive income for these cash flow hedges in fiscal year 2012 is

approximately US$ (4.7) million, net of taxes.

The short-term bridge loan facility was for an aggregate principal amount of US$

500 million. Interest accrued on the short-term bridge loan at LIBOR (as defined in