LensCrafters 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274

|

|

ANNUAL REPORT 2011> 24 |

During 2011 the Group reclassified Euro 132.9 million of certain capitalized software

costs into intangible assets – net, which were previously presented within property,

plant and equipment – net, in order to enhance the presentation of our consolidated

financial position. For further details on the reclassification please refer to note 10 to the

Consolidated Financial Statements as of December 31, 2011.

As of December 31, 2011, as compared to December 31, 2010:

• accounts receivable increased by Euro 58.1 million mainly due to the increase in net

sales during 2011, partially offset by the improvement in days sales outstanding;

• inventory increased by Euro 59.5 million, mainly due to currency fluctuation effects as

well as increased production mainly in the Group’s manufacturing facilities during 2011

and to the currency fluctuation effect.

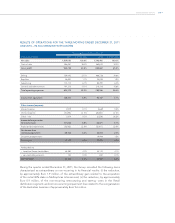

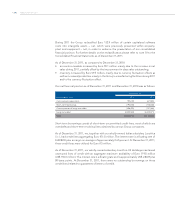

Our net financial position as of December 31, 2011 and December 31, 2010 was as follows:

December 31,

(thousands of Euro) 2011 2010

Cash and cash equivalents 905,100 679,852

Short–term borrowings (193,834) (158,648)

Current portion of long–term debt (498,295) (197,566)

Long–term debt (2,234,583) (2,435,071)

Total (2,031,612) (2,111,433)

Short-term borrowings consist of short–term uncommitted credit lines, most of which are

overdrafts and short-term revolving lines obtained by various Group companies.

As of December 31, 2011, we, together with our wholly-owned Italian subsidiary Luxottica

S.r.l., had credit lines aggregating Euro 431.8 million. The interest rate is a floating rate of

EURIBOR plus a margin on average of approximately 0.65 percent. At December 31, 2011,

these credit lines were utilized for Euro 0.5 million.

As of December 31, 2011, our wholly-owned subsidiary Luxottica US Holdings maintained

unsecured lines of credit with an aggregate maximum availability of Euro 119.8 million

(US$155.0 million). The interest rate is a floating rate and is approximately US$ LIBOR plus

80 basis points. At December 31, 2011, there were no outstanding borrowings on these

credit lines (related to guarantees of letters of credit).