LensCrafters 2011 Annual Report Download - page 238

Download and view the complete annual report

Please find page 238 of the 2011 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274

|

|

ANNUAL REPORT 2011> 162 |

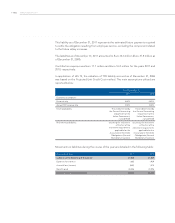

Defined benefit plan data for the current and previous four annual periods are as follows:

(thousands of Euro) 2011 2010 2009 2008 2007

Pension Plans:

Defined benefit obligation 483,738 409,316 334,015 313,520 272,611

Fair value of plan assets 355,563 314,501 238,168 184,379 224,533

Plan surplus/(deficit) 128,175 94,815 95,847 129,141 48,078

Plan liabilities experience gain/(loss) (1,287) 1,744 (1,761) (4,379) (5,212)

Plan assets experience gain/(loss) (28,762) 14,462 23,790 (73,341) (2,619)

SERPs:

Defined benefit obligation 12,344 11,340 11,299 12,015 10,361

Fair value of plan assets –––––

Plan surplus/(deficit) (12,344) (11,340) (11,299) (12,015) (10,361)

Plan liabilities experience gain/(loss) (608) 421 1,228 (927) 2,039

Plan assets experience gain/(loss) –––––

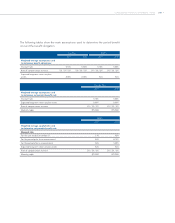

The Group’s discount rate is developed using a third-party yield curve derived from

non-callable bonds of at least an Aa rating by Moody’s Investor Services or at least an

AA rating by Standard & Poor’s. Each bond issue is required to have at least US$ 250

million par outstanding. The yield curve compares the future expected benefit payments

of the Lux Pension Plan to these bond yields to determine an equivalent discount rate.

The Group uses an assumption for salary increases based on a graduated approach of

historical experience. The Group’s experience shows salary increases that typically vary

by age.

In developing the long-term rate of return assumption, the Group considers its asset

allocation. The Group analyzed historical rates of return being earned for each asset

category over various periods of time. Additionally, the Group considered input from

its third-party pension asset managers, investment consultants and plan actuaries,

including their review of asset class return expectations and long-term inflation

assumptions.

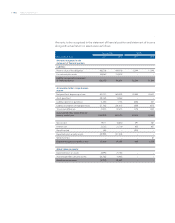

Plan Assets – The Lux Pension Plan’s investment policy is to invest plan assets in a manner

to ensure over a long-term investment horizon that the plan is adequately funded;

maximize investment return within reasonable and prudent levels of risk; and maintain

sufficient liquidity to make timely benefit and administrative expense payments. This

investment policy was developed to provide the framework within which the fiduciary’s

investment decisions are made, establish standards to measure the investment manager’s

and investment consultant’s performance, outline the roles and responsibilities of the

various parties involved, and describe the ongoing review process. The investment

policy identifies target asset allocations for the plan’s assets at 40 percent Large Cap US

Equity, 10 percent Small Cap US Equity, 15 percent International Equity, and 35 percent

Fixed Income Securities, but an allowance is provided for a range of allocations to these

categories as described in the table below.