LensCrafters 2011 Annual Report Download - page 240

Download and view the complete annual report

Please find page 240 of the 2011 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2011> 164 |

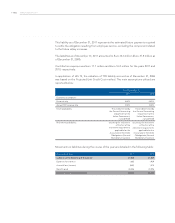

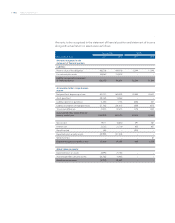

US Holdings sponsors the following additional benefit plans, which cover certain present

and past employees of some of its US subsidiaries:

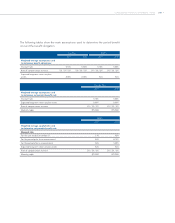

(a) US Holdings provides, under individual agreements, post-employment benefits for

continuation of health care benefits and life insurance coverage to former employees

after employment. As of December 31, 2011 and 2010, the accrued liability related

to these benefits was Euro 657 thousand and Euro 582 thousand, respectively, and

is included in other long-term liabilities in the consolidated statement of financial

position;

(b) US Holdings established and maintains the Cole National Group, Inc. Supplemental

Retirement Benefit Plan, which provides supplemental retirement benefits for certain

highly compensated and management employees who were previously designated

by the former Board of Directors of Cole as participants. This is an unfunded non-

contributory defined contribution plan. Each participant’s account is credited with

interest earned on the average balance during the year. This plan was frozen as to

future salary credits on the effective date of the Cole acquisition in 2004. The plan

liability of Euro 777 thousand and Euro 848 thousand at December 31, 2011 and 2010,

respectively, is included in other long-term liabilities in the consolidated statement of

financial position.

US Holdings sponsors certain defined contribution plans for its United States and Puerto

Rico employees. The cost of contributions incurred in 2011 and 2010 was Euro 4,816

thousand and 0, respectively and was recorded in general and administrative expenses in

the consolidated statement of income. US Holdings also sponsors a defined contribution

plan for all US Oakley associates with at least six months of service. The cost for contributions

incurred in 2011 and 2010 was Euro 1,740 thousand and Euro 1,502 thousand, respectively.

The Group continues to participate in superannuation plans in Australia and Hong Kong.

The plans provide benefits on a defined contribution basis for employees upon retirement,

resignation, disablement or death. Contributions to defined contribution superannuation

plans are recognized as an expense as the contributions are paid or become payable to

the fund. Contributions are accrued based on legislated rates and annual compensation.

The Group’s accrued liability related to this obligation as of December 31, 2011 and 2010

was Euro 5,149 thousand and Euro 3,642 thousand, respectively, and is included in other

long-term liabilities in the consolidated statement of financial position.

Health Benefit Plans – US Holdings partially subsidizes health care benefits for eligible

retirees. Employees generally become eligible for retiree health care benefits when

they retire from active service between the ages of 55 and 65. Benefits are discontinued

at age 65. During 2009, US Holdings provided for a one-time special election of early

retirement to certain associates age 50 or older with 5 or more years of service. Benefits

for this group are also discontinued at age 65 and the resulting special termination

benefit is immaterial.

The plan liability of Euro 3,662 thousand and Euro 3,277 thousand at December 31, 2011

and 2010, respectively, is included in other non-current liabilities in the consolidated

statement of financial position.

The cost of this plan in 2011 and 2010 as well as the 2012 expected contributions are