LensCrafters 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

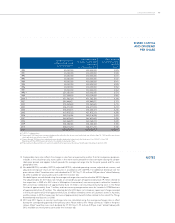

Number of shares (a)

authorized and issued

as of December 31

Adjusted number

of shares (a) authorized

and issued

as of December 31 (b)

Gross dividend

per ordinary shares

(or ADS)

- Euro (c)

1990 45,050,000 450,500,000 0.025

1991 45,050,000 450,500,000 0.028

1992 45,050,000 450,500,000 0.031

1993 45,050,000 450,500,000 0.037

1994 45,050,000 450,500,000 0.041

1995 45,050,000 450,500,000 0.045

1996 45,050,000 450,500,000 0.052

1997 45,050,000 450,500,000 0.063

1998 (b) 225,250,000 450,500,000 0.074

1999 225,269,800 450,539,600 0.085

2000 (b) 451,582,300 451,582,300 0.140

2001 452,865,817 452,865,817 0.170

2002 454,263,600 454,263,600 0.210

2003 454,477,033 454,477,033 0.210

2004 455,205,473 455,205,473 0.230

2005 457,975,723 457,975,723 0.290

2006 460,216,248 460,216,248 0.420

2007 462,623,620 462,623,620 0.490

2008 463,368,233 463,368,233 0.220

2009 464,386,383 464,386,383 0.350

2010 466,077,210 466,077,210 0.440

2011 467,335,177 467,335,177 0.490 (d)

(a) 1 ADS = 1 ordinary share.

(b) Figures until 1999 have been retroactively adjusted to re ect the ve-for-one stock split which was effective April 16, 1998, and the two-for-one

stock split which was effective June 26, 2000.

(c) Figures through 1999 have been calculated converting the dividend in Italian Lira by the xed rate of Lire 1,936.27 = Euro 1.00.

Beginning with the 2000 nancial statements, the dividend is declared in Euro.

(d) Proposed by the Board of Directors and to be submitted for approval at the Annual Stockholders’ Meeting on April 27, 2012.

SHARE CAPITAL

AND DIVIDEND

PER SHARE

NOTES

OTHER INFORMATION

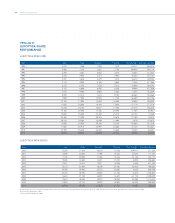

(1) Comparable store sales re ects the change in sales from one period to another that, for comparison purposes,

includes in the calculation only stores open in the more recent period that also were open during the compa-

rable prior period, and applies to both periods the average exchange rate for the prior period and the same

geographic area.

(2) Net debt/EBITDA, net debt, EBITDA, adjusted EBITDA, adjusted operating income, adjusted net income, and

adjusted earnings per share are not measures in accordance with IAS/IFRS. For additional disclosure see the

press release titled “Luxottica raises cash dividend for FY 2011 by 11.4% to Euro 0.49 per share” dated February

28, 2012 available on www.luxottica.com under the Investors tab.

Net debt gures are calculated using the average exchange rates used to calculate EBITDA gures.

The adjusted data for 2011 does not include an extraordinary gain of approximately Euro 19 million related to

the acquisition in 2009 of a 40% stake in Multiopticas Internacional; non-recurring costs related to Luxottica’s

50th anniversary celebrations of approximately Euro 12 million; non-recurring restructuring costs in the Retail

Division of approximately Euro 11 million; and non-recurring reorganization costs for Luxottica’s OPSM business

of approximately Euro 9.5 million. The adjusted data for 2010 does not include an impairment charge recorded

in the fourth quarter of 2010 of approximately Euro 20 million related to certain of Luxottica’s assets in Australia;

and the release in 2010 of a provision for taxes of approximately Euro 20 million related to the sale of the Things

Remembered retail business in 2006.

(3) 2010 and 2011 gures at constant exchange rates are calculated using the average exchange rates in effect

during the corresponding period of the previous year. Please refer to the “Major currencies” table in the press

release titled “Luxottica raises cash dividend for FY 2011 by 11.4% to Euro 0.49 per share” dated February 28,

2012 available on www.luxottica.com under the Investors tab.