LensCrafters 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274

|

|

| 41 >MANAGEMENT REPORT

On January 20, 2012, the Company successfully completed the acquisition of 80 percent

of share capital of the Brazilian entity “Grupo Tecnol Ltd”. The remaining 20 percent will

be acquired starting from 2013 and in the four following years. The Group will purchase

in each of the above mentioned years 5 percent of Grupo Tecnol share capital. The

consideration paid for the 80 percent was approximately Brazilian Real 143.7 million.

The acquisition furthers the Company’s strategy of continued expansion of its wholesale

business in Latin America. The Company uses various methods to calculate the fair value

of the assets acquired and the liabilities assumed. The purchase price allocation was not

completed at the date these Consolidated Financial Statements were authorized for issue.

Luxottica communicated the compliance plan in connection with the transaction pursuant to

the provisions of articles 36–39 of the Market Regulation to Consob and will provide information

on the state of compliance in the financial documents issued under Regulation 11971/1999.

On January 24, 2012 the Board of Directors of Luxottica approved the reorganization of

the retail business in Australia. As a result of this reorganization the Group will close about

10 percent of its Australian and New Zealand stores, redirecting resources into its market

leading OPSM brand. As a result of the reorganization the Group estimates it will incur

approximately expenses of AU$ 40 million, of which approximately AU$ 12 million were

recorded in the 2011 consolidated income statement.

On February 28, 2012 the Board of Directors approved the issuance of senior unsecured

long-term notes to institutional investors prior to the end of 2012. The principal amount

of the notes will be up to Euro 500 million. Final terms of the notes will be determined at

pricing based on market conditions at the time of issuance.

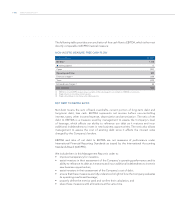

Articles 36–39 of the regulated markets apply to 44 entities based on the financial

statements as of December 31, 2011:

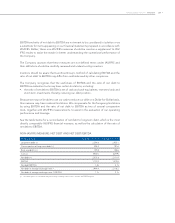

In particular the Group:

• applies to all the Extra European Union subsidiaries, internal procedures under which

it is requested that all Group companies release a quarterly representation letter

that contains a self-certification of the completeness of the accounting information

and controls in place, necessary for the preparation of the consolidated financial

statements of the parent;

• ensures that subsidiaries outside of Europe also declare in these representation letters

their commitment to provide auditors of the Company with the information necessary

to conduct their monitoring of the parent’s annual and interim period financial

statements;

• as set out in Part III, Title II, Chapter II, Section V of Regulation no. 11971/1999 and

subsequent amendments, makes available the balance sheet and income statement

of the aforementioned subsidiaries established in states outside the European Union,

used to prepare the consolidated financial statements:

During 2011, Luxottica acquired control of the capital stock of the Spanish company

Multiopticas Internacional S.L. That company controls the following entities based in

12. SUBSEQUENT

EVENTS

13. ADAPTATION

TO THE ARTICLES

36-39 OF THE

REGULATED

MARKETS