LensCrafters 2011 Annual Report Download - page 227

Download and view the complete annual report

Please find page 227 of the 2011 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

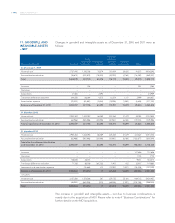

| 151 >CONSOLIDATED FINANCIAL STATEMENTS - NOTES

annum, interest on the Series B Notes accrues at 6.42 percent per annum and interest on

the Series C Notes accrues at 6.77 percent per annum. The 2008 Notes contain certain

financial and operating covenants. The Group was in compliance with those covenants as

of December 31, 2011. The proceeds from the 2008 Notes received on July 1, 2008, were

used to repay a portion of the Bridge Loan Facility (described in (d) below).

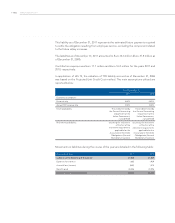

On January 29, 2010, US Holdings closed a private placement of US$ 175 million senior

unsecured guaranteed notes (the “January 2010 Notes”), issued in three series (Series

D, Series E and Series F). The aggregate principal amounts of the Series D, Series E

and Series F Notes are US$ 50 million, US$ 50 million and US$ 75 million, respectively.

The Series D Notes mature on January 29, 2017, the Series E Notes mature on January

29, 2020 and the Series F Notes mature on January 29, 2019. Interest on the Series D

Notes accrues at 5.19 percent per annum, interest on the Series E Notes accrues at

5.75 percent per annum and interest on the Series F Notes accrues at 5.39 percent per

annum. The January 2010 Notes contain certain financial and operating covenants.

The Group was in compliance with those covenants as of December 31, 2011. The

proceeds from the January 2010 Notes received on January 29, 2010, were used for

general corporate purposes.

On September 30, 2010, the Company closed a private placement of Euro 100 million

senior unsecured guaranteed notes (the “September 2010 Notes”), issued in two series

(Series G and Series H). The aggregate principal amounts of the Series G and Series

H Notes are Euro 50 million and Euro 50 million, respectively. The Series G Notes

mature on September 15, 2017 and the Series H Notes mature on September 15, 2020.

Interest on the Series G Notes accrues at 3.75 percent per annum and interest on the

Series H Notes accrues at 4.25 percent per annum. The September 2010 Notes contain

certain financial and operating covenants. The Company was in compliance with those

covenants as of December 31, 2011. The proceeds from the September 2010 Notes

received on September 30, 2010, were used for general corporate purposes.

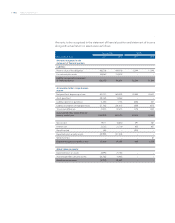

On November 10, 2010, the Company issued senior unsecured guaranteed notes

to institutional investors (Eurobond November 10, 2015) for an aggregate principal

amount of Euro 500 million. The notes mature on November 10, 2015 and interest

accrues at 4.00 percent. The notes are listed on the Luxembourg Stock Exchange

(ISIN XS0557635777). The notes were issued in order to exploit favorable market

conditions and extend the average maturity of the Group’s debt. The Notes contain

certain financial and operating covenants. The Company was in compliance with those

covenants as of December 31, 2011.

On December 15, 2011, US Holdings closed a private placement of US$ 350.0 million

senior unsecured guaranteed notes (the “December 2011 Notes”), issued in one series

(Series I). The Series I Notes mature on December 15, 2021. Interest on the Series I

Notes accrues at 4.35 percent per annum. The December 2011 Notes contain certain

financial and operating covenants. The Group was in compliance with those covenants

as of December 31, 2011.

(c) On June 3, 2004, as amended on March 10, 2006, the Company and US Holdings

entered into a credit facility with a group of banks providing for loans in the aggregate