LensCrafters 2006 Annual Report Download - page 35

Download and view the complete annual report

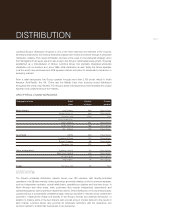

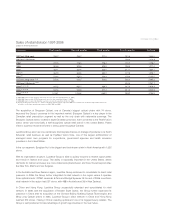

Please find page 35 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISTRIBUTION |35 <

the sun segment, in line with emerging markets’ growing demand for luxury products, and to

marketing efforts.

Overall, Luxottica Group’s wholesale division retained its leadership position in the premium and luxury

segments in 2006, thanks to one of the strongest and most balanced brand portfolios in the industry.

Both house and license brands posted excellent results. Total sales of Ray-Ban were up for the

fourth consecutive year, by 20% in 2006, and positive results were recorded by the other house

brands, especially Vogue, Arnette and Persol, which all met their growth targets.

Sales of the Group’s luxury brands grew 40%. The first Burberry collections, launched in

September 2006, were well received by the market, especially in Europe. This strong performance

is an early endorsement of the license agreement with Burberry, one of the most dynamic and

exclusive luxury brands.

At the end of 2006, Luxottica Group entered a long-term license agreement for the design,

production and exclusive worldwide distribution of Tiffany & Co.’s prescription and sun collections.

This new agreement, marking Tiffany’s debut in the eyewear market, is also significant as yet

another addition to the impressive list of long-term partnerships the Group has entered or renewed

in recent years. These agreements allow the Group time to develop collections and position them

effectively in the market, thus maximizing their potential, each in line with its particular brand values.

This approach has also made it possible to strengthen the very top of the range, thanks to a jewelry

eyewear concept that has had positive results, as in the case of Bvlgari.

The launch of the Polo Ralph Lauren collections in 2007 and Tiffany & Co. in early 2008 will make

the brand portfolio even stronger and better balanced. The portfolio will encompass products

covering the most diverse of consumer tastes and preferences while continuing to attract other

prestige luxury and fashion labels.

Another factor contributing to the wholesale division’s excellent results in 2006 was increased

spending on advertising for both house and license brands. This spending was mainly focused on

enhancing the top brands in the Group’s portfolio in the eyes of both consumers and wholesale

customers.

In 2006, Luxottica Group continued to extend its global organization and add people to its teams in

key countries: the United States, Mexico, Brazil, Italy, Greece, The Netherlands, Russia, India,

Australia, Japan, Spain, France, Germany and the UK. It continued to move its organizational

structures closer to the key markets. The Group improved planning of sales and application of

selective distribution, using the approach adopted by the luxury brands. A structure was also set up

to serve emerging markets and be better prepared to exploit the strong growth prospects in these

markets.

The wholesale division also improved its coverage of Eastern European markets. Offices that the

Group has opened in Russia and Hungary now cover approximately 80% of the East European

region. The Group opened a representative office in China to ensure a more efficient monitoring of

the market and control over distribution. Direct distribution was also started in the important South

Korean market. At the end of 2006, customers served by wholesale distribution numbered around

200,000 worldwide.