LensCrafters 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166

|

|

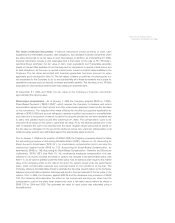

REPORT OF

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM |105 <

Other Accumulated other Treasury

Additional Unearned comprehensive comprehensive shares Consolidated

Common stock paid-in Retained Stock-based income (loss), income (loss), amount, shareholders’

(Euro/000) Shares Amount capital earnings compensation net of tax net of tax at cost equity

(cont’d)

Exercise of stock options 2,240,525 134 24,308 24,443

Translation adjustment (126,853) (126,853) (126,853)

Effect of adoption of SFAS 123 R (48,567) 48,567

Realized stock based compensation 47,969 47,969

Minimum pension, liability, net of taxes

of Euro 0.4 million (624) (624) (624)

Effect of adoption SFAS 158, net of taxes

of Euro 5.5 million (8,409) (8,409) (8,409)

Unrealized gain on available-for-sale securities,

net of taxes of Euro 0.5 million 1,244 1,244 1,244

Diluted gain on business acquisitions, SAB 5-H gain 21,847 21,847

Excess tax benefit on stock options 7,279 7,279

Change in fair value of derivative instruments,

net of taxes of Euro 1.8 million 2,003 2,003 2,003

Dividends declared (Euro 0.29 per share) (131,369) (131,369)

Income from continuing operations 430,705 430,705 430,705

(Loss) on discontinued operations (6,419) (6,419) (6,419)

Comprehensive income 291,647

BALANCES, DECEMBER 31, 2006 460,216,248 27,613 203,016 2,343,800 - (288,593) (69,987) 2,215,849

Comprehensive income (1) 384,886

BALANCES, DECEMBER 31, 2006

(US$/000) (1) 460,216,248 36,440 267,920 3,093,113 - (380,856) (92,362) 2,924,256

(1) Translated for convenience at the New York City Noon Buying Rate as determined in Note 1

See notes to Consolidated Financial Statements.

(*) In accordance with U.S. GAAP.