LensCrafters 2006 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>146 | ANNUAL REPORT 2006

2006 under the older plans, stock options were granted at a price that was equal to or greater than

market value of the shares at the date of grant. Under the 2006 plan, options were granted at the

greater of either the previous 30 day average stock price immediately before the date of grant or

the price on the grant date depending on certain regulatory requirements of the country that the

employee is receiving the option. These options become exercisable in either three equal annual

instalments beginning on January 31st, one year after the date of grant for grants prior to 2005 or

for the 2005 and after grants two annual equal instalments beginning on January 31 two years after

the date of grant and expire on or before January 31, 2015. Certain vested options may contain

accelerated exercising terms if there is a change in ownership (as defined in the Plans).

Prior to the adoption of SFAS 123R on January 1, 2006, the Company applied APB 25 to these

Annual plans, and as such no compensation expense was recognized because the exercise price

of the options was equal to the fair market value on the date of grant. Accounting for the

performance plans are discussed below. However, as some of those individuals were U.S.

citizens/taxpayers and as the exercise of such options created taxable income, the Company was

afforded a tax benefit in its US Federal tax return equal to the income declared by the individuals.

U.S. GAAP does not permit the aforementioned tax benefit to be recorded in the statement of

income. Therefore, such amount is recorded as a reduction of taxes payable and an increase to

additional paid-in capital. For the years ended December 31, 2004 and 2005, the benefit recorded

approximated Euro 0.8 million and Euro 4.7 million, respectively.

The Company adopted SFAS 123R as of January 1, 2006, and at such point began expensing

stock options on a straigh-line basis over the requisite service period based on their fair value as of

the date of grant. For the year ended December 31, 2006 Euro 7.0 million of compensation

expense has been recorded for these plans. Pro forma net income and earnings per share

calculated as if the compensation costs of the plans had been determined under a fair-value

based method for the previous periods are reported in Note 1.

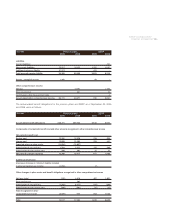

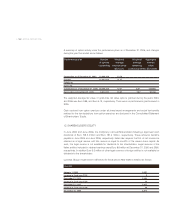

Asummary of option activity under the Plans as of December 31, 2006, and changes during the

year then ended is as follows:

Number Weighted Weighted Aggregate

of options average average intrinsic

outstanding (denominated remaining value

in Euro) contractual (Euro/000)

(1) terms

Outstanding as of December 31, 2005 10,044,310 12.68

Granted 1,725,000 22.19

Forfeitures (228,100) 15.86

Exercised (2,240,525) 10.59

Outstanding as of December 31, 2006 9,300,685 14.15 5.33 84,899

Exercisable at December 31, 2006 5,555,285 11.05 3.95 67,917

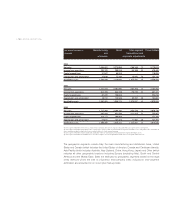

The weighted-average fair value of grant-date fair value options granted during the years 2004,

2005, and 2006 was Euro 4.10, Euro 4.27 and Euro 5.72, respectively.

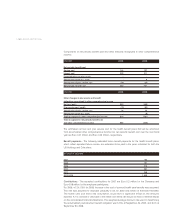

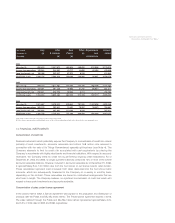

Stock performance plans

In October 2004, under a Company performance plan, the Company granted options to acquire an

aggregate of 1,000,000 shares of the Company to certain employees of North American Luxottica