LensCrafters 2006 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>124 | ANNUAL REPORT 2006

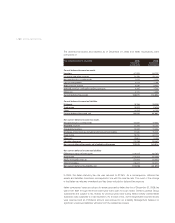

The following unaudited proforma information for the year ended December 31, 2004 summarizes

the results of operations as if the acquisition of Cole had been completed on January 1, 2004 and

includes certain pro forma adjustments such as additional amortization expense attributable to

identifiable intangibles:

(Euro/000, except per share data - Unaudited) 2004

Net sales 4,027,057

Income from operations 488,223

Net income 276,212

No. of shares (thousands) - Basic 448,275

No. of shares (thousands) - Diluted 450,361

Earnings per share (Euro) - Basic 0.62

Earnings per share (Euro) - Diluted 0.61

This pro forma financial information is presented for informational purposes only and is not

necessarily indicative of the results of operations that would have been achieved had the

acquisition taken place on January 1, 2004.

On October 17, 2004, Cole caused its subsidiary to purchase Euro 122.2 million (US$ 150 million)

of its outstanding 8 7/8% Senior Subordinated Notes due 2012 in a tender offer and consent

solicitation for Euro 143 million (US$ 175.5 million), which amount represented all of the issued and

outstanding notes of such series. On November 30, 2004, Cole redeemed all of its outstanding 8

5/8% Senior Subordinated Notes due 2007 for Euro 103.0 million (US$ 126.4 million).

c) Other acquisitions and establishments

The following is a description of other acquisitions and establishments. No pro forma financial

information is presented, as these acquisitions individually or in aggregate were not material to the

Company's consolidated financial statements.

•In April 2005, the Company purchased 26 stores from SunShade Holding Corporation and

Hao’s International. The acquisition was accounted for in accordance with SFAS 141 and,

accordingly, the purchase price of Euro 11.1 million has been allocated to the fair market value

of the assets and liabilities of the company as defined by the asset purchase agreement. All

valuations of net assets including but not limited to fixed assets and inventory were completed

during 2006 and goodwill for an amount of Euro 7.8 million in excess of the net assets acquired

has been recorded in the accompanying Consolidated Balance Sheets. No pro forma financial

information is presented, as the acquisition was not material to the Company's consolidated

financial statements. The acquisition was made as result of the Company’s strategy to continue

expansion of its retail business in North America.

•In September 2005, the Company purchased 27 stores in Canada from Symbol of Sight, Ltd

known as Precision Optical. The acquisition was accounted for in accordance with SFAS 141

and, accordingly, the purchase price of Euro 13.8 million has been allocated to the fair market

value of the assets and liabilities of the company as defined by the asset purchase agreement.

All valuations of net assets including but not limited to fixed assets and inventory were

completed during 2006, and goodwill for an amount of Euro 11.9 million in excess of the net

assets acquired has been recorded in the accompanying Consolidated Balance Sheets. No pro

forma financial information is presented, as the acquisition was not material to the Company's

consolidated financial statements. The acquisition was made as result of the Company’s

strategy to continue expansion of its retail business in Canada.