LensCrafters 2006 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166

|

|

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS |131 <

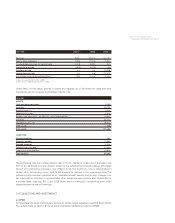

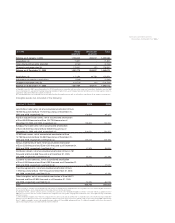

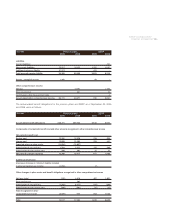

Reconciliation between the Italian statutory tax rate and the effective tax rate is as follows:

Year ended December 31, 2004 2005 2006

Italian statutory tax rate 37.3% 37.3% 37.3%

Aggregate effect of different rates in foreign jurisdictions 0.5% 1.7% (1.5%)

Aggregate Italian tax benefit, net - (4.1%)

Aggregate effect of asset revaluation in Australia (6.8%)

Permanent differences, principally losses in subsidiary

companies funded through capital contributions, net

of non-deductible goodwill (2.4%) - -

Effect on stock-based compensation 3.0% 5.5%

Aggregate other effects - (0.9%) 0.7%

Effective rate 35.4% 37.0% 35.2%

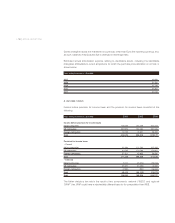

The 2005 aggregate Italian tax benefit is caused by the Company complying with an Italian law that

allows for the step up in tax basis of certain intangible assets.

The 2006 tax benefit results from the adoption of a change in the tax law in Australia, which introduced a

tax consolidation regime for wholly owned group entities. The tax consolidation rules effectively pushed

down the cost of acquiring an entity (or group of entities) to the assets that the entity (or group) owns.

This resulted in resetting of asset cost basis for tax purposes, and in the relevant uplifts in fixed assets

and intangibles as at the date of tax consolidation which occurred in December 2006 when OPSM

lodged the consolidated 2005 tax return.

Beginning with fiscal year 2004, for income tax purposes, the Company and its Italian subsidiaries file

tax returns on a consolidated basis.