LensCrafters 2006 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166

|

|

>130 | ANNUAL REPORT 2006

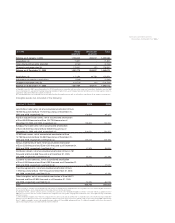

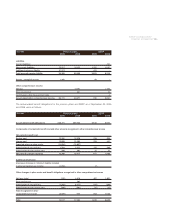

Certain intangible assets are maintained in currencies other than Euro (the reporting currency) and,

as such, balances may fluctuate due to changes in exchange rates.

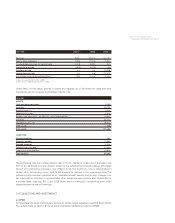

Estimated annual amortization expense relating to identifiable assets, including the identifiable

intangibles attributable to recent acquisitions for which the purchase price allocation is not final, is

shown below:

Years ending December 31, (Euro/000)

2007 60,869

2008 51,431

2009 51,429

2010 51,362

2011 51,243

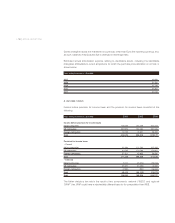

8. INCOME TAXES

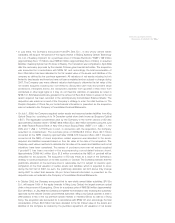

Income before provision for income taxes and the provision for income taxes consisted of the

following:

Years ending December 31, (Euro/000) 2004 2005 2006

Income before provision for income taxes

Italian companies 149,479 216,438 251,343

US companies 222,973 244,050 331,035

Foreign companies 72,123 78,821 95,799

Total 444,575 539,309 678,177

Provision for income taxes

•Current

Italian companies 23,194 127,730 157,343

US companies 60,543 120,784 120,681

Foreign companies 27,701 40,855 33,206

Total 111,348 289,369 311,229

•Deferred

Italian companies 9,017 (74,874) (23,016)

US companies 39,377 (14,295) (3,392)

Foreign companies (2,980) (934) (46,065)

Total 45,414 (90,103) (72,473)

Total 156,852 199,266 238,757

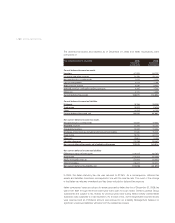

The Italian statutory tax rate is the result of two components: national (“IRES”) and regional

(“IRAP”) tax. IRAP could have a substantially different base for its computation than IRES.