LensCrafters 2006 Annual Report Download - page 135

Download and view the complete annual report

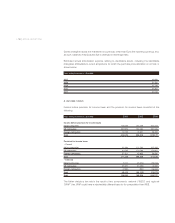

Please find page 135 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The credit facility was guaranteed by Luxottica Group. The term loan portion of the credit facility

provided US$ 200 million of borrowing and required repayment of equal quarterly principal

instalments beginning in March 2003. The revolving loan portion of the credit facility allowed for a

maximum borrowing of US$ 150 million. Interest accrued at Libor as defined in the agreement plus

0.5% and the credit facility allowed the Company to select interest periods of one, two or three

months. The credit facility contained certain financial and operating covenants.

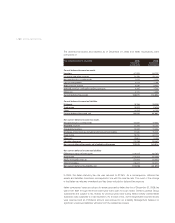

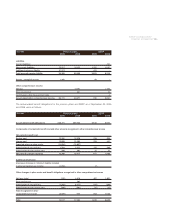

(c) On September 3, 2003, US Holdings closed a private placement of US$ 300 million (Euro 253.3

million) of senior unsecured guaranteed notes (the “Notes”), issued in three series (Series A,

Series B and Series C). Interest on the Series A Notes accrues at 3.94% per annum and interest on

Series B and Series C Notes accrues at 4.45% per annum. The Series A and Series B Notes

mature on September 3, 2008 and the Series C Notes mature on September 3, 2010. The Series A

and Series C Notes require annual prepayments beginning on September 3, 2006 through the

applicable dates of maturity. The Notes are guaranteed on a senior unsecured basis by the

Company and Luxottica S.r.l., a wholly owned subsidiary. The notes contain certain financial and

operating covenants. US Holdings was in compliance with those covenants as of December 31,

2006. In December 2005, US Holdings terminated the fair value interest rate swap agreement

described below,and as such, US Holdings will amortize the final adjustment to the carrying

amount of the hedged interest-bearing financial instruments as an adjustment to the fixed-rate

debt yield over the remaining life of the debt. The effective interest rates on the Series A, B, and C

Notes for their remaining lives are 5.64%, 5.99%, and 5.44%, respectively.Under this credit facility

Euro 246.3 million and Euro 165.0 million were outstanding as of December 31, 2005 and 2006,

respectively.

In connection with the issuance of the Notes, US Holdings entered into three interest rate swap

agreements with Deutsche Bank AG (the “DB Swaps”). The three separate agreements’ notional

amounts and interest payment dates coincided with the Notes. The DB Swaps exchanged the fixed

rate of the Notes for a floating rate of the six-month Libor rate plus 0.6575% for the Series A Notes

and the six-month Libor rate plus 0.73% for the Series B and Series C Notes. These swaps were

treated as fair value hedges of the related debt and qualified for the shortcut method of hedge

accounting (assuming no ineffectiveness in a hedge in an interest rate swap). Thus the interest

income/expense on the swaps was recorded as an adjustment to the interest expense on the debt,

effectively changing the debt from a fixed rate of interest to the swap rate. In December 2005, the

Company terminated the DB Swaps. The Company paid the bank an aggregate of

Euro 7.0 million (US$ 8.4 million), excluding accrued interest, for the final settlement of the DB Swaps.

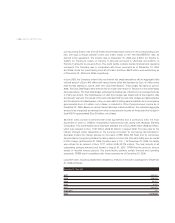

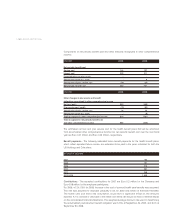

(d) On June 3, 2004, as amended on March 10, 2006, the Company and US Holdings entered

into a credit facility with a group of banks providing for loans in the aggregate principal amount

of Euro 1,130 million and US$ 325 million. The five-year facility consists of three Tranches

(Tranche A, Tranche B, Tranche C). The March 2006 amendment increased the available

borrowings, decreased the interest margin and defined a new maturity date of five years from

the date of the amendment for Tranche B and Tranche C. Tranche A is a Euro 405 million

amortizing term loan requiring repayment of nine equal quarterly instalments of principal of Euro

45 million beginning in June 2007, which is to be used for general corporate purposes, including

the refinancing of existing Luxottica Group S.p.A. debt as it matures. Tranche B is a term loan of

US$ 325 million which was drawn upon on October 1, 2004 by US Holdings to finance the

purchase price of the acquisition of Cole. Amounts borrowed under Tranche B will mature in

March 2011. Tranche C is a Revolving Credit Facility of Euro 725 million-equivalent multi-

currency (Euro/US$). Amounts borrowed under Tranche C may be repaid and reborrowed with

all outstanding balances maturing in March 2011. The Company can select interest periods of

one, two, three or six months with interest accruing on Euro-denominated loans based on the

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS |135 <