LensCrafters 2006 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>136 | ANNUAL REPORT 2006

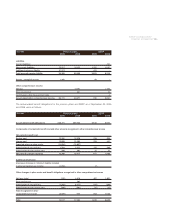

corresponding Euribor rate and US Dollar denominated loans based on the corresponding Libor

rate, both plus a margin between 0.20% and 0.40% based on the “Net Debt/EBITDA” ratio, as

defined in the agreement. The interest rate on December 31, 2006 was 3.972% for Tranche A,

5.620% for Tranche B, 5.60% on Tranche C amounts borrowed in US Dollar and 3.957% on

Tranche C amounts borrowed in Euro. The credit facility contains certain financial and operating

covenants. The Company was in compliance with those covenants as of December 31, 2005

and 2006. Under this credit facility, Euro 974.3 million and Euro 895.2 million was outstanding as

of December 31, 2005 and 2006, respectively.

In June 2005, the Company entered into nine interest rate swap transactions with an aggregate initial

notional amount of Euro 405 million with various banks which will decrease by Euro 45 million every

three months starting on June 3, 2007 (the “Club Deal Swaps”). These swaps will expire on June 3,

2009. The Club Deal Swaps were entered into as a cash flow hedge on Tranche A of the credit facility

discussed above. The Club Deal Swaps exchange the floating rate of Euribor for an average fixed rate

of 2.40% per annum. The ineffectiveness of cash flow hedges was tested both at the inception date

and at each year end. The results of the tests indicated that the cash flow hedges are highly effective

and the amounts of ineffectiveness, if any, on each date of testing were immaterial. As a consequence

approximately Euro 5.2 million, net of taxes, is included in Other Comprehensive Income as of

December 31, 2006. Based on current interest rates and market conditions, the estimated aggregate

amount to be recognized as earnings from other comprehensive income for these cash flow hedges in

fiscal 2007 is approximately Euro 3.6 million, net of taxes.

(e) Other loans consist of several small credit agreements and a promissory note, the most

significant of which is OPSM's renegotiated multicurrency loan facility with Westpac Banking

Corporation. This credit facility had a maximum available line of Euro 29.96 million (AU$ 50 million),

which was reduced to Euro 17.97 million (AU$ 30 million) in August 2006. The base rate for the

interest charged varies depending on the currency borrowed; for borrowings denominated in

Australian Dollars the interest accrues on the basis of BBR (Bank Bill Rate) and for borrowings

denominated in Hong Kong Dollars the rate is based on Hibor (HK Inter bank Rate) plus an overall

0.275% margin (at December 31 2006, the Hibor was 4.11%, ). At December 31, 2006, the facility

was utilized for an amount of Euro 12,11 million (AU$ 20.219 million). The final maturity of all

outstanding principal amounts and interest is August 31, 2007. OPSM has the option to choose

weekly or monthly interest periods. The credit facility contains certain financial and operating

covenants. OPSM was in compliance with these covenants as of December 31, 2006.

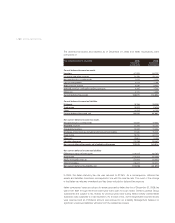

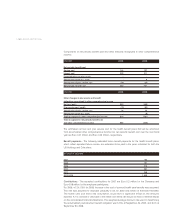

Long-term debt, including capital lease obligations, matures in the years subsequent to December

31, 2006 as follows:

December 31, (Euro/000)

2007 359,527

2008 358,988

2009 99,927

2010 9,087

2011 490,967

Thereafter 766

Total 1,319,262