LensCrafters 2006 Annual Report Download - page 127

Download and view the complete annual report

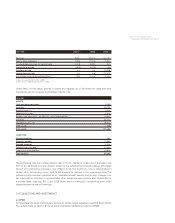

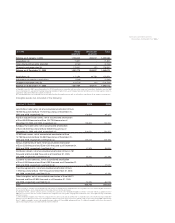

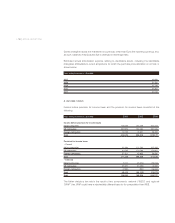

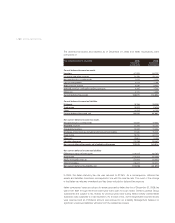

Please find page 127 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS |127 <

accompanying Consolidated Balance Sheets. The acquisition was made as a result of the

Company’s strategy to continue expansion of its retail business in The People’s Republic of

China. No pro forma financial information is presented, as the acquisition was not material to the

Company’s Consolidated Financial Statements.

d) Pending acquisitions

•In February 2007, the Company completed the acquisition of certain assets and assumed certain

liabilities of D.O.C Optics Corporation and its affiliates, an optical retail business with

approximately 100 stores located primarily in the Midwest United States of America for

approximately US$ 110 millions in cash (Euro 83.4 million converted at the December 31, 2006

Noon Buying Rate as discussed in Note 1). The Company expects to convert the stores acquired

to the current operating names, “LensCrafters” and “Pearle”. The acquisition will be accounted for

in accordance with SFAS 141, and accordingly, the purchase price including direct acquisition-

related expenses will be allocated to the assets acquired and liabilities assumed based on their

fair value at the date of the acquisition. The acquisition was made as a result of the Company’s

strategy to continue expansion of its retail business in the United States of America.

•On January 25, 2007, Luxottica Group announced that, in compliance with directions issued by

the Supreme Court of India on December 12, 2006, it intends to launch a public offer to acquire

up to an additional 20% of the equity shares of RayBan Sun Optics India Ltd. through the Group’s

subsidiary,RayBan Indian Holdings, Inc. RayBan Sun Optics India Ltd. is a company listed on the

Bombay Stock Exchange.

Should the offer be fully accepted, Luxottica Group’s indirect interests in RayBan Sun Optics India

Ltd. will increase to approximately 64%, from its current 44% stake. The Group acquired its interest

in RayBan Sun Optics India Ltd. in connection with the purchase of the Ray-Ban eyewear business

from Bausch & Lomb in 1999.

Luxottica Group expects the maximum investment related to this offer to be approximately Euro 11

million, including incremental interest to be paid to certain shareholders. These amounts will not

have a material financial impact on the Group.

•On March 23, 2007 Luxottica Group announced that it has acquired two prominent specialty sun

chains in South Africa, with a total of 65 stores. The two acquisitions represent an important step

in the expansion of the Company’s sun retail presence worldwide. Luxottica Group’s total

investment in the two transactions will be approximately Euro 10 million. Both transactions are

expected to close during the second quarter of 2007, subject to customary closing conditions.