LensCrafters 2006 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

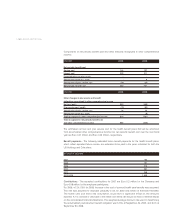

The weighted-average discount rate used in determining the net periodic benefit cost for 2005 and

2006 was 5.75%, respectively.

New accounting pronouncement -In the fourth quarter of 2006, the Company adopted SFAS no.

158, which requires employers to recognize on the balance sheet the projected benefit obligation

of pension plans and the accumulated postretirement benefit obligation for any other

postretirement plan. This requirement replaces the requirement of SFAS no. 87 to report a

minimum pension liability measured as the excess of the accumulated benefit obligation over the

fair value of plan assets and any recorded pension accrual. SFAS no. 158 also requires employers

to recognize in other comprehensive income gains or losses and prior service costs or credits that

occur during the period but would not be recognized as net periodic benefit cost as required by

SFAS no. 87, 88, and 106. There is no change in the requirements related to the income statement

recognition of net periodic benefit costs. The incremental effect of applying SFAS no. 158 on the

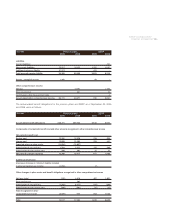

consolidated balance sheet at December 31, 2006 is as follows:

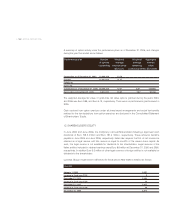

Incremental effects of applying SFAS no. 158 on individual line items in the Consolidated

Balance Sheet as of December 31, 2006

(Euro/000) Before Adjustments After

application application

of SFAS no. 158 of SFAS no. 158

Prepaid pension

(intangible assets) (304) 2,254 1,950

Total assets 4,912,771 2,254 4,915,025

Current liabilities - SFAS no. 106 - 185 185

Current liabilities - pension benefits - 232 232

Total current liabilities 1,424,860 417 1,425,277

Long-term SFAS no. 106 4,055 (405) 3,650

Long-term pension benefits 45,961 17,583 63,544

Non-current deferred income taxes 48,202 (6,932) 41,270

Total long-term liabilities 1,263,653 10,246 1,273,899

Accumulated other comprehensive loss (258,335) (8,409) (266,744)

Total shareholders’ equity 2,224,258 (8,409) 2,215,849

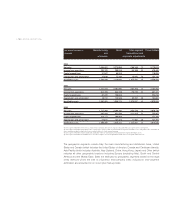

11. STOCK OPTION AND INCENTIVE PLANS

Stock option plan

Beginning in April 1998, certain officers and other key employees of the Company and its

subsidiaries were granted stock options of Luxottica Group S.p.A.under the Company’s stock

option plans (the “plans”). The aggregate number of shares permitted to be granted under these

plans to the employees is 21,299,300. The Company believes that the granting of options to these

key employees better aligns the interest of such employees with those of the shareholders. Prior to

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS |145 <