LensCrafters 2006 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

|109 <

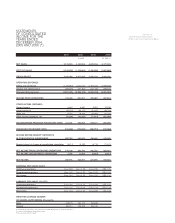

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Organization -Luxottica Group S.p.A. and its subsidiaries (collectively "Luxottica Group" or the

"Company") operate in two industry segments: (1) manufacturing and wholesale distribution and (2) retail

distribution. Through its manufacturing and wholesale distribution operations, Luxottica Group is

engaged in the design, manufacturing, wholesale distribution and marketing of house brand and

designer lines of mid to premium-priced prescription frames and sunglasses. Through the Company’s

retail operations the Company owns and operates 5,280 retail locations worldwide and franchises an

additional 439 locations under certain of its owned trade names. At December 31, 2006 the Company’s

retail operations by geographic region and significant tradenames were as follows:

North America Europe Australia China Total

New Zealand Hong Kong

LensCrafters 902 75 977

Sunglass Hut 1,502 92 224 1,818

Pearle and Licensed Brands 1,781 1,781

Other 505 199 704

Franchised locations 417 22 439

4,602 92 751 274 5,719

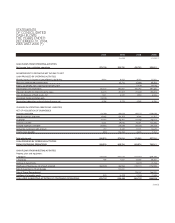

Principles of consolidation and basis of presentation -The consolidated financial statements

of Luxottica Group include the financial statements of the parent company, all wholly or majority-

owned subsidiaries and variable interest entities for which the Company is determined to be the

primary beneficiary. A subsidiary of the Company located in the United States holds a 44%

interest in an affiliated manufacturing and wholesale distributor, located and publicly traded in

India, and the Company owns a 50% interest in an affiliated company located in Great Britain,

which are both accounted for under the equity method. The results of operations of these

investments are not material to the results of the operations of the Company. Investments in

other companies in which the Company has less than a 20% interest with no ability to exercise

significant influence are carried at cost. All significant intercompany accounts and transactions

are eliminated in consolidation. Luxottica Group prepares its consolidated financial statements

in accordance with accounting principles generally accepted in the United States of America

(“U.S. GAAP”).

In accordance with Financial Accounting Standard Board (“FASB”) Statement of Financial

Accounting Standard (“SFAS”) no. 141, Business Combinations,we account for all business

combinations under the purchase method. Furthermore, we recognize intangible assets apart from

goodwill if they arise from contractual or legal rights or if they are separable from goodwill.

The comparative figures include a variable interest entity (the “Trust”) consisting of a synthetic

operating lease for Cole’s former Things Remembered Specialty Gift Business (“TR”) of Cole

National Corporation (“Cole”) which was sold in September 2006 (see Note 4). The Trust was

included in these consolidated financial statements since the Company was required to absorb any

expected losses, received the majority of expected returns on the activities of the Trust, and was the

primary beneficiary of the Trust. Assets of Euro 1.6 million and liabilities of Euro 1.6 million were

consolidated into the financial statements as of December 31, 2005. In January 2006, the Company

reached an agreement with the Trust to allow for the acceleration of the purchase option and

acquired the facility for a purchase price of approximately Euro 1.5 million (the amount of the

underlying liability plus transaction costs). Therefore, the liability related to the Trust was included as

acurrent liability (“liabilities of discontinued operations”) as of December 31, 2005.

NOTES

TO CONSOLIDATED

FINANCIAL STATEMENTS