LensCrafters 2006 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

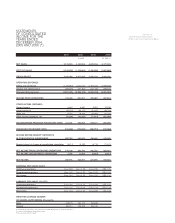

2004 2005 2006 2006

(Euro/000) (US$/000) (1)

CASH FLOWS FROM OPERATING ACTIVITIES

Net income from continuing operations 279,109 330,790 430,705 568,401

ADJUSTMENTS TO RECONCILE NET INCOME TO NET

CASH PROVIDED BY OPERATING ACTIVITIES

Minority interest in income of consolidated subsidiaries 8,614 9,253 8,715 11,501

Non cash stock-based compensation 22,711 47,969 63,304

Excess tax benefits from stock-based compensation (7,279) (9,606)

Depreciation and amortization 150,140 184,652 220,797 291,386

Provision (benefit) for deferred income taxes 46,570 (91,297) (72,509) (95,691)

Loss on disposals of fixed assets, net 7,641 6,559 4,930 6,506

Unrealized foreign exchange gain (13,445)

Termination indemnities matured during the year, net 6,768 3,723 4,369 5,766

CHANGES IN OPERATING ASSETS AND LIABILITIES,

NET OF ACQUISITION OF BUSINESSES

Accounts receivable (14,298) (33,634) (83,107) (109,676)

Prepaid expenses and other 19,963 (56,767) 8,568 11,307

Inventories 34,190 66,491 (27,658) (36,501)

Accounts payable 6,241 49,615 76,021 100,325

Accrued expenses and other (22,951) (18,549) (25,243) (33,313)

Accrual for customers' right of return 727 5,448 11,121 14,677

Income taxes payable (950) 126,708 5,875 7,754

Total adjustments 229,210 274,914 172,569 227,740

CASH PROVIDED BYOPERATING ACTIVITIES

FROM CONTINUING OPERATIONS

508,319 605,704 603,274 796,141

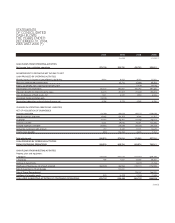

CASH FLOWS FROM INVESTING ACTIVITIES

Property,plant and equipment:

• Additions (116,626) (220,016) (272,180) (359,196)

•Disposals 198 1,022 21,563 28,457

Increase in investments (5,872) (7,750)

Purchases of businesses net of cash acquired (362,978) (86,966) (134,114) (176,990)

Sale of investment in Pearle Europe 144,000

Sale of Things Remembered 128,007 168,931

Additions of intangible assets (301) (4,479) (1,140) (1,505)

CASH USED IN INVESTING ACTIVITIES OF CONTINUING OPERATIONS (479,707) (166,439) (263,737) (348,053)

(cont’d)

STATEMENTS

OF CONSOLIDATED

CASH FLOWS

THE YEARS ENDED

DECEMBER 31, 2004,

2005 AND 2006 (*)