LensCrafters 2006 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

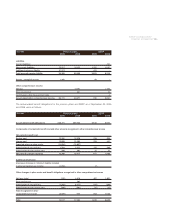

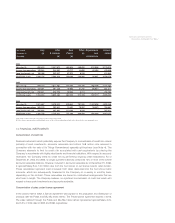

Asummary of option activity under the performance plans as of December 31, 2006, and changes

during the year then ended are as follows:

Performance plan Number Weighted Weighted Aggregate

of options average average intrinsic

oustanding exercise price remaining value

(Euro) (1) contractual terms (Euro/000)

Outstanding as of December 31, 2005 10,600,000 13.79

Granted 13,000,000 21.27

Forfeitures

Exercised

Outstanding as of December 31, 2006 23,600,000 17.91 8.61 126,696

Exercisable at December 31, 2006 9,600,000 13.67 7.67 92,256

The weighted-average fair value of grant-date fair value options granted during the years 2004,

and 2006 was Euro 3.99, and Euro 5.13, respectively. There were no performance grants issued in

2005.

Cash received from option exercises under all share-based arrangements and actual tax benefits

realized for the tax deductions from option exercises are disclosed in the Consolidated Statement

of Shareholders’ Equity.

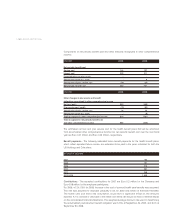

12. SHAREHOLDERS' EQUITY

In June 2005 and June 2006, the Company’s Annual Shareholders Meetings approved cash

dividends of Euro 103.5 million and Euro 131.4 million, respectively. These amounts became

payable in June 2005 and June 2006, respectively.Italian law requires that 5% of net income be

retained as a legal reserve until this reserve is equal to one-fifth of the issued share capital. As

such, this legal reserve is not available for dividends to the shareholders. Legal reserves of the

Italian entities included in retained earnings were Euro 8.6 million at December 31, 2005 and 2006,

respectively. In addition Euro 5.3 million of other legal reserves of foreign entities is not available for

dividends to the shareholders.

Luxottica Group’s legal reserve rollforward for fiscal period 2004-2006 is detailed as follows:

(Euro/000)

January 1, 2004 5,451

Increase in fiscal year 2004 3

December 31, 2004 5,454

Increase in fiscal year 2005 23

December 31, 2005 5,477

Increase in fiscal year 2006 36

December 31, 2006 5,513

>148 | ANNUAL REPORT 2006