LensCrafters 2006 Annual Report Download - page 142

Download and view the complete annual report

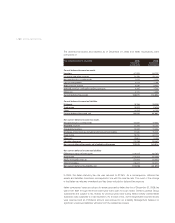

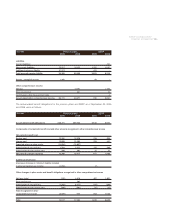

Please find page 142 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and Euro 1.2 million respectively, and is included in the accrued employee benefits on the

consolidated balance sheet. The decrease in the liability in 2006 is largely attributable to a

change in the benefit plans offered which provided for an increase in the cost sharing by

participants and the actuarial rating of the claims cost related to the benefit structure. There was

also a decrease related to the drop in plan participants.

•Effective January 1, 2006, the Cole defined contribution plan was merged into the Company’s

tax incentive savings plan. For the Cole qualified defined contribution plans offered through

December 31, 2005, covering all full time employees of the U.S., the Company’s matching

contribution in 2006 for fiscal 2005 was approximately Euro 0.8 million.

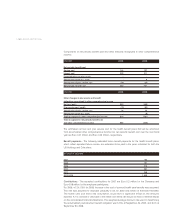

•Cole also maintains a defined contribution plan covering all full-time employees in Puerto Rico.

The employees in Puerto Rico who have in the past participated in the Company’s tax incentive

savings plan were transferred into the Cole plan effective January 1, 2006. Additionally, effective

January 1, 2006, the plan was amended to provide for a match of 100% of the first 3% of

employee contributions. In 2006, the Company made quarterly contributions in cash to the plan

based on a percentage of employees’ contributions. During 2005, this plan provided for a

mandatory match of 50% of the employees first 6% of employee contributions. The matching

contributions to such plan for the year ended 2006 and 2005 were immaterial.

•Cole established and maintains the Cole National Group, Inc. Supplemental Retirement Benefit

Plan, which provides supplemental retirement benefits for certain highly compensated and

management employees who were previously designated by the former Board of Directors of

Cole as participants. This is an unfunded noncontributory defined contribution plan. Each

participant’s account is credited with interest earned on the average balance during the year.

This plan was frozen as to future salary credits on the effective date of the Cole acquisition in

2004. The plan liability of Euro 1.7 million and Euro 1.3 million at December 31, 2005 and 2006,

respectively, is included in accrued employee benefits on the consolidated balance sheets.

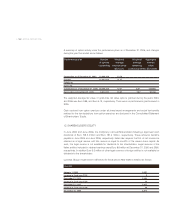

Defined contribution plan -The Company sponsors a noncontributory profit-sharing plan for

employees of its former women’s apparel business. Contributions to this plan were discontinued

for plan years subsequent to January 28, 1995. This plan is in termination status as the Company

attempts to locate the few remaining participants with account balances.

The Company continues to participate in superannuation plans in Australia and Hong Kong. The

plans provide benefits on a defined contribution basis for employees on retirement, resignation,

disablement or death. Contributions to defined contribution superannuation plans are recognized

as an expense as the contributions are paid or become payable to the fund. Contributions are

accrued based on legislated rates and annual compensation.

Health benefit plans -The Company partially subsidizes health care benefits for eligible retirees of

certain subsidiaries in the United States of America. Employees generally become eligible for

retiree health care benefits when they retire from active service between the ages of 55 and 65.

Benefits are discontinued at age 65.

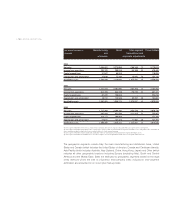

As of the Cole acquisition date, the Company assumed a liability for a postretirement benefit plan

maintained by Cole in connection with its acquisition of Pearle in 1996. This plan was closed to

new participants at the time of Cole’s acquisition of Pearle. Under this plan, the eligible former

employees are provided life insurance and certain health care benefits which are partially

subsidized by Cole. Medical benefits under this plan can be maintained past age 65.

>142 | ANNUAL REPORT 2006