LensCrafters 2006 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>120 | ANNUAL REPORT 2006

As of January 1, 2006, the Company has adopted SFAS 123(R) in accordance with the transitional

guidance as prescribed in the statement. As such, the previous unearned compensation as of

December 31, 2005 of Euro 48.6 million has been charged against the appropriate equity

accounts. Approximately Euro 48.0 million of additional compensation expense associated with

the annual stock option plans and with the Company's October 2004 performance plan grants,

September 2004 shareholder grant and July 2006 performance plans grants was included in

general and administrative expense for the fiscal year ended December 2006.

Total receivables and payables from/to other related parties not considered in the above reported

paragraphs amount to Euro 1.3 million and Euro 0.2 million, respectively (Euro 0.5 million and

Euro 0.1 million as of December 31, 2005). These amounts mainly refer to commercial transaction

with the company RayBan Sun Optics India Ltd held by the Group at 44% as of December 31, 2006.

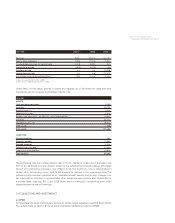

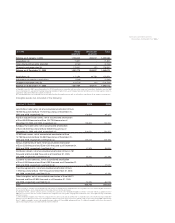

3. INVENTORIES

Inventories consisted of the following:

Years ended December 31, (Euro/000) 2005 2006

Raw materials and packaging 53,414 76,352

Work in process 26,932 49,650

Finished goods 349,048 317,253

Less: Inventory obsolescence reserves (59,105) (42,360)

Total 370,289 400,895

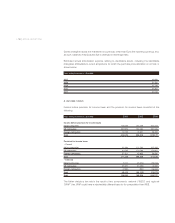

4. SALE OF THINGS REMEMBERED

On September 29, 2006, the Company sold its TR specialty gifts retail business to a private equity

consortium for net cash consideration of Euro 128.0 million (US$ 162.1 including costs of US$ 5.3

million) and a promissory note with a principal amount of Euro 20.6 million (US$ 26.1 million). The

TR business operated solely in the United States and was included in the retail segment of the

Company’s operations as of December 31, 2004 and 2005. As such, for all periods for which a

balance sheet is presented, the Company has reclassified the assets and liabilities included in the

sale for previous periods as single asset and liability line items on the balance sheet. In the

Statements of Consolidated Income, for all periods presented, the Company has reclassified

sales, cost of sales and other expenses associated with the discontinued operations as a single

line item after income from continuing operations but before net income. Revenues, income from

operations, income before provision for income taxes and income tax provision reclassified under

discontinued operations for the twelve-month periods ended December 31, 2004, 2005 and 2006,

are as follows: