LensCrafters 2006 Annual Report Download - page 115

Download and view the complete annual report

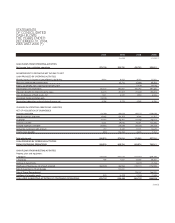

Please find page 115 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS |115 <

Fair value of financial instruments -Financial instruments consist primarily of cash, cash

equivalents and marketable securities, debt obligations, and derivative financial instruments which

are either accounted for as fair value or cash flow hedges. In addition, as of December 31, 2006,

financial instruments include a note receivable from a third party for the sale of TR (“TR Note”).

Luxottica Group estimates the fair value of cash, cash equivalents and marketable securities

based on interest rates available to the Company and by comparison to quoted market prices and

its debt obligations, as there are no quoted market prices, based on interest rates available to the

Company. The fair value associated with financial guarantees has been accrued for when

applicable and is disclosed in Note 15. The fair values of letters of credit are not disclosed as it is

not practicable for the Company to do so and substantially all of these instruments are in place for

operational purposes such as security on leases and health benefits. The fair value of the TR Note

was based on discounted projected cash flows utilizing an expected yield.

At December 31, 2005 and 2006, the fair value of the Company's financial instruments

approximated the carrying value.

Stock-based compensation -As of January 1, 2006 the Company adopted SFAS no. 123(R),

Share Based Payments (“SFAS 123(R)”) which requires the Company to measure and record

compensation expense for stock options and other share-based payments based on the fair value

of the instruments. The adoption was made utilizing the modified prospective application as

defined in SFAS 123(R) and as such will apply to awards modified, repurchased or cancelled after

such date and to any portion of awards for which the requisite service has not been rendered and

to every new granted award issued after December 31, 2005. The compensation costs to be

recorded will be based on the option’s grant-date fair value. As for the awards granted prior to the

date of adoption the cost to be recorded over the future requiste service period will be based on

the fair value as calculated for the pro-forma disclosure below. Any unearned compensation cost

related to earlier awards were eliminated against the appropriate equity accounts.

Prior to January 1, 2006 and its adoption of SFAS 123(R) the Company previously elected to follow

the accounting provisions of Accounting Principles Board (“APB”), Opinion no. 25, Accounting for

Stock Issued to Employees (“APB 25”), for stock-based compensation and to provide the

disclosures required under SFAS no. 123, Accounting for Stock-Based Compensation,as

amended by SFAS no. 148, Accounting for Stock-Based Compensation - Transition and Disclosure

(collectively,“SFAS 123”) (see Note 11). No stock-based employee compensation cost was

reflected in net income for 2004 and 2005 for options not included in the performance plans (see

Note 11), as all options granted under the these plans had an exercise price equal to the market

value of the underlying stock on the date of the grant. For options issued under the performance

plans, stock compensation expense was recorded based on the conditions of the plan. The

Company utilizes a binomial lattice model to estimate the fair value of each option as the Company

believes a binomial lattice valuation technique will result in the best estimate of the fair value of the

options. Prior to 2006, the Company applied APB 25 and the disclosure-only provisions of SFAS

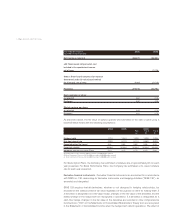

123. The following table illustrates the effect on net income and earnings per share had the

compensation costs of the plans been determined under a fair-value based method as stated in

SFAS 123 for 2004 and 2005. The estimated fair value for each option was calculated using a

binomial model.