LensCrafters 2006 Annual Report Download - page 137

Download and view the complete annual report

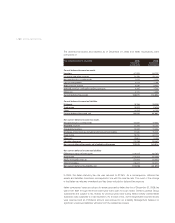

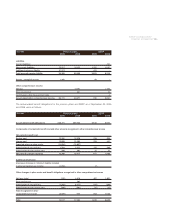

Please find page 137 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10. EMPLOYEE BENEFITS

Liability for termination indemnities -As required by Italian labor legislation, the benefit accrued

by an employee for service to date is payable immediately upon separation. Accordingly, the

undiscounted value of that benefit payable exceeds the actuarial present value of that benefit

because payment is estimated to occur at the employee’s expected termination date. The

Company measures the vested benefit obligation at the actuarial present value of the vested

benefits to which the employee would be entitled if all employees were to resign or be terminated

as of the balance sheet date. Each year, the Company adjusts its accrual based upon headcount,

changes in compensation level and inflation. This liability is not funded. There are also some

termination indemnities in other countries which are provided through payroll tax and other social

contributions in accordance with local statutory requirements. The related charge to earnings for

the years ended December 31, 2004, 2005 and 2006 aggregated Euro 10.4 million, Euro 12.0

million and Euro 12.9 million, respectively.

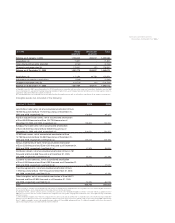

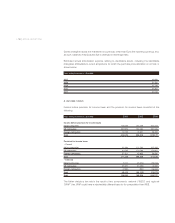

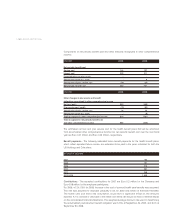

Qualified pension plans -During fiscal years 2006 and 2005, the Company continued to

sponsor a qualified noncontributory defined benefit pension plan, which provides for the

payment of benefits to eligible past and present employees of the Company upon retirement.

Pension benefits are accrued based on length of service and annual compensation under a

cash balance formula.

This pension plan was amended effective January 1, 2006, granting eligibility to associates who

work in the certain Cole stores, field management, and the related labs and distribution centers.

Additionally,the Company amended the pension accrual formula for the Cole associates, as well

as all new hires for the Company. The new formula has a more gradual benefit accrual pattern.

However, the Pension Plan Protection Act of 2006 will require a change to the Plan’s vesting

schedule effective January 1, 2008.

As of the effective date of the Cole acquisition, the Company assumed sponsorship of the Cole

National Group, Inc. Retirement Plan (“Cole Plan”). This is a qualified noncontributory defined

benefit pension plan that covers Cole employees who have met eligibility service requirements and

are not members of certain collective bargaining units. The pension plan provides for benefits to

be paid to eligible past and present employees at retirement based primarily upon years of service

and the employees’ compensation levels near retirement.

In January 2002, the Cole Plan was frozen for all participants. The average pay for all participants

was frozen as of March 31, 2002, and covered compensation was frozen as of December 31,

2001. Benefit service was also frozen as of March 31, 2002, except for those who were age 50 with

10 years of benefit service as of that same date, whose service will continue to increase as long as

they remain employed by the Company.

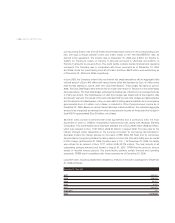

Nonqualified pension plans and agreements -The Company also maintains a nonqualified,

unfunded supplemental executive retirement plan (“SERP”) for participants of its qualified pension

plan to provide benefits in excess of amounts permitted under the provisions of prevailing tax law.

The pension liability and expense associated with this plan are accrued using the same actuarial

methods and assumptions as those used for the qualified pension plan.

Starting January 1, 2006, this plan’s benefit provisions were amended to mirror the changes made

to the Company’s qualified pension plan.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS |137 <