LensCrafters 2006 Annual Report Download - page 147

Download and view the complete annual report

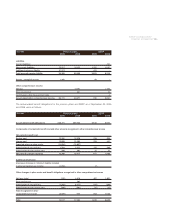

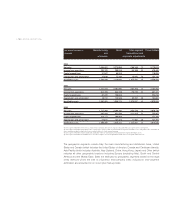

Please find page 147 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Retail Division which vested and became exercisable on January 31, 2007 as certain financial

performance measures were met over the period ending December 2006. At December 31, 2005,

there were options to acquire 1,000,000 shares (the closing ADR price at December 31, 2005 on the

New York Stock Exchange was US$ 25.31 per share) at an exercise price of US$ 18.59 per share.

Prior to the adoption of SFAS 123(R) compensation expense was recorded in accordance with

variable accounting under APB 25 for the options issued under the incentive plan based on the

market value of the underlying ordinary shares when the number of shares to be issued is known

(“intrinsic value method”). During fiscal 2005, it became probable that the incentive targets would be

met and as such the Company has recorded approximately Euro 1.8 million (or US$ 2.2 million) of

compensation expense net of taxes during fiscal 2005 and recorded future unearned compensation

expense in equity of approximately Euro 2.7 million (US$ 3.2 million) with an offsetting increase in

additional paid-in capital for such amounts. Pro forma net income and earnings per share calculated

as if the compensation costs of the plans had been determined under a fair-value based method are

reported in Note 1.

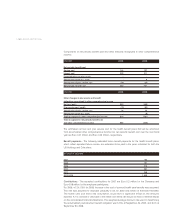

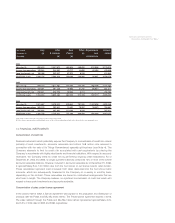

In September 2004, the Company’s Chairman and majority shareholder, Mr. Leonardo Del Vecchio,

allocated shares held through La Leonardo Finanziaria S.r.l., an Italian holding company of the Del

Vecchio family, representing 2.11% (or 9.6 million shares) of the Company’s currently authorized and

issued share capital, to a stock option plan for top management of the Company at an exercise price

of Euro 13.67 per share (the closing stock price at December 31, 2005 on the Milan Stock Exchange

was Euro 21.43 per share). The stock options to be issued under the stock option plan vest upon

meeting certain economic objectives. As such, compensation expense is recorded in accordance

with variable accounting under APB 25 for the options issued to management under the incentive

plan based on the market value of the underlying ordinary shares only when the number of shares to

be vested and issued is known. During 2005, it became probable that the incentive targets would be

met and, as such, the Company has recorded compensation expense of approximately Euro 19.9,

net of taxes and recorded future unearned compensation expense in equity of approximately

Euro 45.8 million, net of taxes, with an offsetting increase in additional paid-in capital for such

amounts. The expense if calculated under SFAS 123 would have been approximately Euro 16.9

million, net of taxes, and is included in pro forma net income and earnings per share (see Note 1).

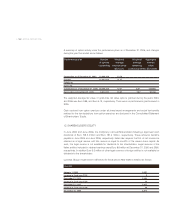

In July 2006, under a Company performance plan, the Company granted options to acquire an

aggregate of 13,000,000 shares of the Company to certain top management positions through out

the Company which vest and became exercisable as certain financial performance measures will be

met. Upon vesting the associate will be able to exercise such options until they expire in 2016.

Currently it is expected that these performance conditions will be met. If these performance

measures are not expected to be met no additional compensation costs will be recognized and

previous compensation costs recognized will be reversed.

For the year ended December 31, 2006 Euro 40.9 million of compensation expense has been

recorded for these plans.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS |147 <