LensCrafters 2006 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.>134 | ANNUAL REPORT 2006

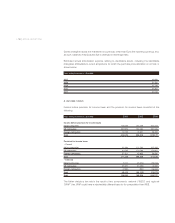

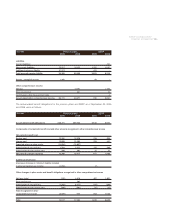

In December 2002, the Company entered into two interest rate swap transactions (the “Intesa

Swaps”) beginning with an aggregate maximum notional amount of Euro 250 million, which

decreased by Euro 100 million on June 27, 2004 and by Euro 25 million in each subsequent three-

month period. The Intesa Swaps expired on December 27, 2005. The Intesa Swaps were entered

into as a cash flow hedge on a portion of the Banca Intesa Euro 650 million unsecured credit

facility discussed above. As such changes in the fair value of the Intesa Swaps were included in

OCI until they were recorded in the financial statements. The Intesa Swaps exchanged the floating

rate based on Euribor for a fixed rate of 2.985% per annum.

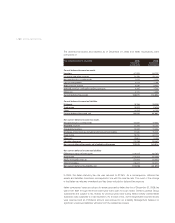

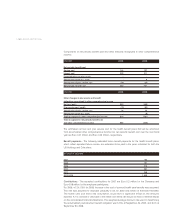

In September 2003, the Company acquired its ownership interest of OPSM and more than 90% of

the performance rights and options of OPSM for an aggregate of AU$ 442.7 million (Euro 253.7

million), including acquisition expenses. The purchase price was paid for with the proceeds of a

credit facility with Banca Intesa S.p.A. of Euro 200 million, in addition to other short-term lines

available. The credit facility includes a Euro 150 million term loan, which will require repayment of

equal semi-annual instalments of principal of Euro 30 million starting on September 30, 2006 until

the final maturity date. Interest accrues on the term loan at Euribor (as defined in the agreement)

plus 0.55% (4.272% on December 31, 2006). The revolving loan provides borrowing availability of

up to Euro 50 million; amounts borrowed under the revolving portion can be borrowed and repaid

until final maturity.At December 31, 2006, Euro 25 million had been drawn from the revolving

portion. Interest accrues on the revolving loan at Euribor (as defined in the agreement) plus 0.55%

(4.098% on December 31, 2006). The final maturity of the credit facility is September 30, 2008. The

Company can select interest periods of one, two or three months. The credit facility contains

certain financial and operating covenants. The Company was in compliance with those covenants

as of December 31, 2006. Under this credit facility Euro 175 million and Euro 145 million were

outstanding as of December 31, 2005 and 2006, respectively.

In June 2005, the Company entered into four interest rate swap transactions with various banks

with an aggregate initial notional amount of Euro 120 million which will decrease by Euro 30 million

every six months starting on March 30, 2007 (“Intesa OPSM Swaps”). These swaps will expire on

September 30, 2008. The Intesa OPSM Swaps were entered into as a cash flow hedge on a

portion of the Banca Intesa Euro 200 million unsecured credit facility discussed above. The Intesa

OPSM Swaps exchange the floating rate of Euribor for an average fixed rate of 2.38% per annum.

The ineffectiveness of cash flow hedges was tested both at the inception date and at each year

end. The results of the tests indicated that the cash flow hedges are highly effective and the

amounts of ineffectiveness, if any, on each date of testing were immaterial. As a consequence

approximately Euro 1.2 million, net of taxes, is included in Other Comprehensive Income as of

December 31, 2006. Based on current interest rates and market conditions, the estimated

aggregate amount to be recognized as earnings from other comprehensive income for these cash

flow hedges in fiscal 2007 is approximately Euro 0.95 million, net of taxes.

In December 2005, the Company entered into a new unsecured credit facility with Banco Popolare

di Verona e Novara. The 18-month credit facility consists of a revolving loan that provides

borrowing availability of up to Euro 100 million; amounts borrowed under the revolving portion can

be borrowed and repaid until final maturity. At December 31, 2006, Euro 100 million had been

drawn from the revolving portion. Interest accrues on the revolving loan at Euribor (as defined in

the agreement) plus 0.25% (3.89% on December 31, 2006). The final maturity of the credit facility is

June 1, 2007. The Company can select interest periods of one, three or six months. Under this

credit facility, Euro 100 million was outstanding as of December 31, 2006.

(b) In June 2002, US Holdings entered into a US$ 350 million credit facility with a group of four

Italian banks led by UniCredito Italiano S.p.A. which was paid in full upon its maturity in June 2005.