LensCrafters 2006 Annual Report Download - page 149

Download and view the complete annual report

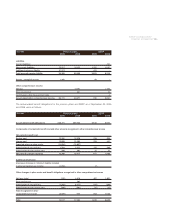

Please find page 149 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In accordance with SFAS no. 87, Employers’ Accounting for Pensions, Luxottica Group has

recorded minimum pension liabilities for the underfunded U.S. defined benefit pension plans of

Euro 32.2 million and Euro 29.6 million as of December 31, 2005 and 2006, respectively,

representing the excess of unfunded accumulated benefit obligations over previously accrued

pension liabilities. An intangible asset equal to the amount of unrecognized prior service cost was

also recorded. The amount by which the unfunded accumulated benefit obligations exceeded the

intangible asset and accrued pension liability was charged directly to shareholders’ equity net of

income taxes. The principal cause of the increase in minimum liability in 2006 is due to the

accumulated benefit obligations increasing more than the pension assets increased as a result of

investment performance net of benefit payments and plan expenses. As of December 31, 2006,

the increase in the minimum liability plus the decrease in the intangible asset resulted in a

decrease of Euro 0.6 million in shareholders’ equity. The liability recognition provision of SFAS no.

158 Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans was

adopted for the year ended December 31, 2006. As a result, there was an additional after tax

charge to shareholders’ equity of Euro 8.4 million. This charge is because SFAS no. 158 requires

the use of the higher projected benefit obligation amount, as compared to the accumulated benefit

obligation, in determining the amount of pension liability that is required to be recognized on

Luxottica’s balance sheet.

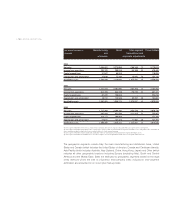

Previously the Board of Directors authorized US Holdings to repurchase through the open market

up to 21,500,000 ADRs of Luxottica Group S.p.A., representing at that time approximately 4.7% of

the authorized and issue share capital. As of December 31, 2004, both repurchase programs

expired and US Holdings has purchased 6,434,786 (1,911,700 in 2002 and 4,523,786 in 2003)

ADRs at an aggregate purchase price of Euro 70.0 million (US$ 73.8 million translated at the

exchange rate at the time of the transactions). In connection with the repurchase, an amount of

Euro 70.0 million is classified as treasury shares in the Company’s consolidated financial

statements. The market value of the stock based on the ADR price as listed on the New York Stock

Exchange at December 31, 2006, is approximately Euro 149.7 million (US$ 197.6 million).

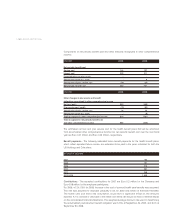

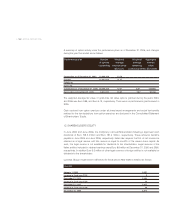

13. SEGMENTS AND RELATED INFORMATION

In accordance with SFAS no. 131, Disclosures About Segments of an Enterprise and Related

Information, the Company operates in two industry segments:(1) manufacturing and wholesale

distribution and (2) retail distribution. Through its manufacturing and wholesale distribution operations,

the Company is engaged in the design, manufacture, wholesale distribution and marketing of house

brand and designer lines of mid- to premium-priced prescription frames and sunglasses. The

Company operates in the retail segment through its Retail Division, consisting of LensCrafters,

Sunglass Hut International, OPSM, Cole National, Xueliang, Ming Long and Modern Sight.

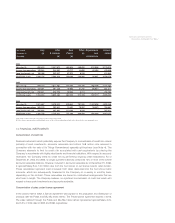

The following tables summarize the segmental and geographic information deemed essential by

the Company’s management for the purpose of evaluating the Company’s performance and for

making decisions about future allocations of resources.

The “Inter-segment transactions and corporate adjustments” column includes the elimination of

inter-segment activities which consist primarily of sales of product from the manufacturing and

wholesale segment to the retail segment and corporate related expenses not allocated to

reportable segments. This has the effect of increasing reportable operating profit for the

manufacturing and wholesale and retail segments. Identifiable assets are those tangible and

intangible assets used in operations in each segment. Corporate identifiable assets are principally

cash, goodwill and trade names.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS |149 <