LensCrafters 2006 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISTRIBUTION |29 <

The acquisition of Shoppers Optical, one of Canada’s biggest optical chains with 74 stores,

improved the Group’s presence in this important market. Shoppers Optical is a key player in the

Canadian retail prescription segment as well as the only chain with nationwide coverage. The

Shoppers Optical stores, located in eight Canadian provinces, were converted to the Pearle Vision

brand, which was historically a well-recognized optical retail brand in the United States. Pearle

Vision’s business model and brand is being used throughout Canada.

Luxottica Group also has nine central lens finishing labs that are of strategic importance to its North

American retail business as well as EyeMed Vision Care, one of the largest administrator of

managed vision care programs for corporations, government agencies and health insurance

providers in the United States.

In the sun segment, Sunglass Hut is the biggest and best-known chain in North America with 1,502

stores.

With its organization structure, Luxottica Group is able to quickly respond to market opportunities

and trends in fashion and luxury. This ability is especially important in the United States, where

demands for fashion and luxury are now a nationwide phenomenon and have moved beyond cities

like New York, Miami and Los Angeles.

In the Australia and New Zealand region, Luxottica Group continued to consolidate its direct retail

presence. In 2006, the Group further integrated its retail network in the region, where it operates

three optical brands: OPSM, Laubman & Pank and Budget Eyewear. At the end of 2006, Luxottica’s

retail network in the region had 527 stores, with 488 in Australia and 39 in New Zealand.

In China and Hong Kong, Luxottica Group successfully extended and consolidated its retail

network. In 2006, with the acquisition of Modern Sight Optics, the Group further expanded its

presence in China after its acquisition of the Chinese Beijing Xueliang Optical Technologies and

Ming Long Optical chains in 2005. Luxottica Group’s direct network in China and Hong Kong

reached 270 stores, making it China’s leading optical and one of its biggest luxury retailers. The

Group is well positioned to take advantage of growth opportunities in the near future.

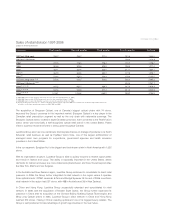

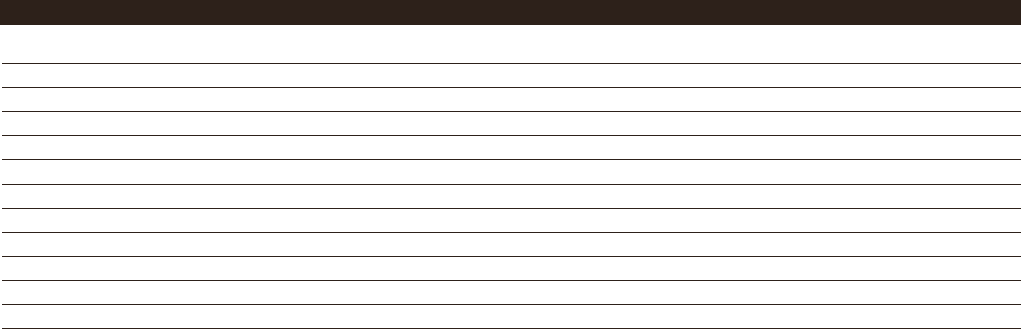

(1) 2001-2006 figures include Sunglass Hut results since the date of acquisition (March 31, 2001).

(2) 2003-2006 figures include OPSM Group results since the date acquisition (August 1, 2003).

(3) 2004-2006 figures include Cole National result since the date of acquisition (October 4, 2004).

(4) Results of Things Remembered, Inc., a former subsidiary that was sold in September 2006, are reclassified as discontinued operations and are not

included in results from continuing operations for 2004, 2005 and 2006.

(US$/million) First quarter Second quarter Third quarter Fourth quarter Full year

1997 incl. 53rd week 250.7 256.7 271.0 261.6 1,040.0

1997 excl. 53rd week 238.4 1,016.8

1998 280.8 278.6 298.4 270.9 1,128.7

1999 324.6 323.6 329.9 299.3 1,277.4

2000 352.1 342.9 346.0 311.1 1,352.1

2001 (1) 362.9 553.3 530.2 477.3 1,923.7

2002 (1) 516.4 553.0 556.4 479.4 2,105.2

2003 incl. 53rd week (1) (2) 510.8 542.7 603.6 636.2 2,293.3

2003 excl. 53rd week (1) (2) 594.5 2,251.7

2004 (1) (2) (3) (4) 641.5 662.7 668.3 847.3 2,819.9

2005 (1) (2) (3) (4) 942.4 978.9 977.4 911.3 3,809.9

2006 (1) (2) (3) (4) 1,018.1 1,054.8 1,069.2 993.2 4,135.3

Sales of retail division 1997-2006

(Subject to limited audit review)