LensCrafters 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.>34 | ANNUAL REPORT 2006

inside department stores in the United States, Sunglass Hut has cultivated a young, active and

fashion-conscious image. It is now the leader in the high-end sun retail market.

In 2006, Sunglass Hut completed its brand repositioning with the goal of capturing more fashion-

minded consumers. The results of this process, which started in 2001 following the Group’s acquisition

of Sunglass Hut, have been a key contributor to the chain’s excellent performance over the last two

years. The repositioning effort has also solidified the chain’s foundation for future growth. In general,

2006 was a year of strong improvement for Sunglass Hut. Concentrating increasingly on fashion and

luxury, and with a special focus on fashion-sensitive women, Sunglass Hut’s sales, on a same store

basis, rose nearly three times the average growth in retail sales in the United States.

In the United States, Sunglass Hut further expanded with 90 new store openings and a restyling of

another 153 stores, mainly in the key states of California, Florida, Texas and New York. In 2007, an

additional 120 stores will be remodeled. Fashion products were popular, driven mainly by oversize

designer sunglasses and by the launch of two new brands: Dolce & Gabbana in 300 stores and

D&G in 1,300 stores.

In Australia and New Zealand during 2006, Sunglass Hut strengthened its position by acquiring 50

stores and securing a number of stores at major airports. Its market presence in the fashion and

luxury segment grew, with the largest increase occurring in the luxury brands, where sales rose 79%.

Brand awareness rose from 52% to 60%, with women in the 25-to-39-age bracket accounting for

much of this improvement.

Strengthened by these results, Sunglass Hut plans to expand in Southeast Asia and Hong Kong,

early in 2007. Sunglass Hut is already operating five stores in major shopping centers in Singapore.

In Europe, Sunglass Hut has 92 stores in the UK. In 2006, it initiated a significant reorganization of

its network and business plans to improve its brand positioning. The store format was redesigned,

stores were moved to more favorable locations, preferably in airports, city high streets and

shopping centers, and the product mix was improved. This process gave a strong boost to

Sunglass Hut’s sales, especially in the luxury segment, with sales above the general retail average

in the UK. Expansion plans contemplate ten new store openings per year for the next three years.

WHOLESALE

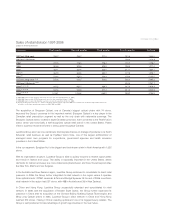

Good results in all the main markets contributed to the wholesale division’s record 30.9% growth in

sales. Sales exceeded Euro 1.7 billion, mainly due to an improving brand portfolio over the last few

years, and grew 26% over 2005. Operating income rose 46.5% in 2006 and reached Euro 445.8

million. Sales to wholesale customers grew 28.6%.

Geographically, the wholesale business continued to grow at rates above the market average in

most countries where the Group operates. In Europe, which is the most important market for this

division, Luxottica Group continued to improve its positioning, even in countries where the overall

market did not grow in terms of value.

Wholesale saw significant growth in the United States, thanks to both restructuring efforts and the

growing trend towards fashion eyewear, especially in the sun segment.

In Asia, growth was consistent and substantial, confirming the Group’s leadership position in Japan,

Korea and Hong Kong. In emerging markets, wholesale sales rose 60%, indicating another area for

future expansion. Strong growth was due above all to the fashion and luxury brands, particularly in