LensCrafters 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

| 71 <

Luxottica Group prepared the consolidated financial statements contained in this report in accordance with

generally accepted U.S. accounting principles known as U.S. GAAP. Luxottica Group, through the approval

of CONSOB (Report No. 27021 of April 7, 2000), decided that preparing its financial and economic

statements in accordance with U.S. GAAP, rather than the corresponding International Accounting

Standards / International Financial Reporting Standards, IAS / IFRS, was opportune for the following reasons:

• it maintains continuity and consistency with the financial information reported in previous years, which

were prepared under U.S. GAAP, facilitating their comparison;

• it maintains continuity and consistency in the Group’s consolidated financial statements and those of its

U.S. subsidiaries (prepared under U.S. GAAP), which account for over 50% of the Group’s results.

Luxottica Group makes available the consolidated financial statements prepared in accordance with

International Accounting Standards / International Financial Reporting Standards (IAS/IFRS), in

compliance with EEC regulations (EEC Regulation No. 1606/2002). Beginning with the financial

statements for fiscal year 2005, European companies listed on the Stock Exchange must prepare their

consolidated financial statements in accordance with IAS/IFRS. In the table on the following page, the

differences between the two consolidated financial statements are expanded upon, with reference to

the statements of consolidated income for fiscal year 2005.

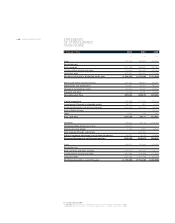

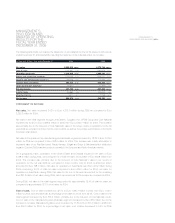

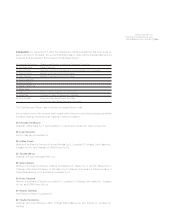

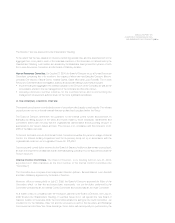

RECONCILIATION

OF THE CONSOLIDATED INCOME

STATEMENT PREPARED IN ACCORDANCE

WITH U.S. GAAP AND IAS / IFRS

For year ended december 31, 2005 U.S. GAAP IAS 19 IAS 38 IAS 39 IFRS 2 IFRS 3 Other Total IAS / IFRS

December 31, Employee Intangible Derivatives Stock Business minor & adjustments December 31,

In thousands of Euro (1) 2005 benefit depreciation Option combination reclassifications IAS / IFRS 2005

Net sales 4,370,744 4,370,744

Cost of sales (1,380,653) 2,016 (5,361) (3,345) (1,383,999)

Gross profits 2,990,091 2,016 (5,361) (3,345) 2,986,745

Operating expenses

Selling expenses (1,564,006) (630) (630) (1,564,636)

Royalties (67,050) (145) (145) (67,195)

Advertising expenses (278,691) (3,117) (816) (3,933) (282,624)

General and administrative expenses (423,619) 2,063 (2,195) 5,929 (4,996) 801 (422,819)

Trademark amortization (54,170) (54,170)

Total (2,387,537) 2,063 (3,117) (2,195) 5,929 (6,587) (3,907) (2,391,445)

Operating income 602,554 4,078 (3,117) (2,195) 5,929 (11,948) (7,253) 595,301

Other income (expenses)

Interest expenses (66,332) (2,471) 4 (2,467) (68,799)

Interest income 5,650 5,650

Other - net 15,697 4,176 4,176 19,873

Other income (expenses), net (44,985) (2,471) 4,180 1,709 (43,276)

Income before provision for income taxes

557,569 4,078 (3,117) (2,471) (2,195) 5,929 (7,768) (5,544) 552,025

Provision for income taxes (206,022) (1,392) 930 1,104 (2,067) 2,676 1,250 (204,771)

Income before minority interest

in income of consolidated subsidiaries 351,547 2,686 (3,117) (1,541) (1,092) 3,863 (5,092) (4,293) 347,254

Minority interest in income

of consolidated subsidiaries (9,253) (4) (4) (9,257)

Net income 342,294 2,686 (3,117) (1,541) (1,092) 3,863 (5,096) (4,297) 337,997

Earnings per share (ADS) (1) 0.76 0.75

Fully diluted earnings per share (ADS) 0.76 0.75

Weighted average number

of outstanding shares 450,179 450,179

Fully diluted average number of shares 453,303 453,303

(1) Except earnings per share (ADS), which are expressed in Euro.