LensCrafters 2005 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 118 | ANNUAL REPORT 2005

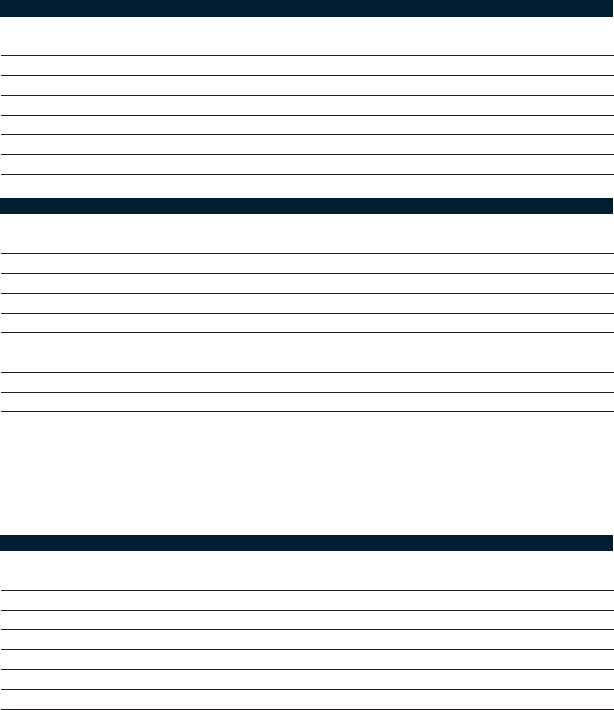

In thousands of Euro Assets purchased

Cash and cash equivalents 5,990

Inventories 23,623

Property, plant and equipment 49,781

Prepaid expenses and other current assets 7,433

Accounts receivable 1,064

Trade name (useful life of 25 years, no residual value) 141,195

Other assets including deferred tax assets 12,616

In thousands of Euro Liabilities assumed

Accounts payable and accrued expenses (34,831)

Other current liabilities (11,426)

Deferred tax liabilities (42,359)

Minority interests (11,246)

Bank overdraft (42,914)

Fair value of net assets 98,926

Goodwill 154,750

Total purchase price 253,676

The following unaudited pro forma information for the year ended December 31, 2003 summarizes the

results of operations as if the acquisition of OPSM had been completed on January 1, 2003 and

includes certain pro forma adjustments such as additional amortization of the trade name recorded at

the acquisition date:

In thousands of Euro, except per share data - Unaudited 2003

Net sales 3,018,670

Income from operations 439,676

Net income 266,188

No. of shares (thousands) - Basic 448,664

No. of shares (thousands) - Diluted 450,202

Earnings per share (Euro) - Basic 0.59

Earnings per share (Euro) - Diluted 0.59

This pro forma financial information is presented for informational purposes only and is not necessarily

indicative of the results of operations that would have been achieved had the acquisition taken place on

January 1, 2003.

On November 26, 2004, the Company, through its wholly owned subsidiary, Luxottica South Pacific Pty

Limited, made an offer for all the un-owned remaining outstanding shares of OPSM.

On February 7, 2005, on the close of the offer, the Company acquired 15.5% for an aggregate total of

98.5% of OPSM’s shares, which is in excess of the compulsory acquisition threshold. Subsequently, the

Company announced the start of the compulsory acquisition process for all remaining shares in OPSM

not already owned by the Company. The compulsory acquisition process was completed on March 23,

2005 and as of that date the Company held 100% of OPSM’s shares. The acquisition of the remaining

OPSM shares was accounted for in accordance with SFAS 141, and accordingly, the purchase price of

Euro 61.9 million or A$ 102.9 million in cash (including approximately A$ 3.5 million of direct acquisition-