LensCrafters 2005 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED

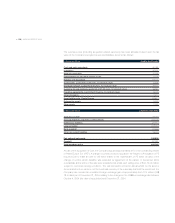

FINANCIAL STATEMENTS | 119 <

related expenses and dividends to receive) was allocated to the assets acquired and liabilities assumed

based on their fair value at the date of the acquisition. Since there was no additional fair value of assets

acquired and liabilities assumed, the difference between the purchase price and the value of the

minority interest in OPSM has been allocated entirely to goodwill for an amount of Euro 46.3 million (A$

77.7 million).

b) I.C. Optics

On January 13, 2003, the Company announced the signing of a worldwide license agreement for the

design, production and distribution of Versace, Versus and Versace Sport sunglasses and prescription

frames. The initial ten-year agreement is renewable for an additional ten years. The transaction was

completed through the purchase of IC Optics Group (“IC Optics”), an Italian-based group that

produces and distributes eyewear, for an aggregate amount of Euro 5.4 million. Prior to this transaction,

Gianni Versace S.p.A. and Italocremona S.p.A. held IC Optics through a 50/50 joint venture. The

acquisition was accounted for in accordance with SFAS 141 and, accordingly, the purchase price has

been allocated to the fair market value of the assets and liabilities of the company acquired including an

intangible asset for the license agreement for an amount of approximately Euro 28.8 million and goodwill

for an amount of approximately Euro 10.7 million. Further, an amount of Euro 25 million has been paid

for an option right, which enables the Company to extend the original royalty agreement for an additional

ten years. No pro forma financial information is presented, as the acquisition was not material to the

Company’s Consolidated Financial Statements.

c) E.I.D.

On July 23, 2003, the Company announced the signing of a ten-year worldwide license agreement for

exclusive production and distribution of prescription frames and sunglasses with the Prada and Miu Miu

names. The deal was finalized through Luxottica’s purchase of two of Prada’s fully-owned companies,

E.I.D. Italia and E.I.D. Luxembourg, that produce and distribute eyewear, for the amount of Euro 26.5

million. The acquisition was accounted for in accordance with SFAS 141 and, accordingly, the purchase

price has been allocated to the fair market value of the assets and liabilities of the companies acquired

including an intangible asset for the license agreement for an amount of approximately Euro 29.7 million.

Goodwill for an amount of Euro 11.1 million over net assets acquired has been recorded in the

accompanying Consolidated Balance Sheet. No pro forma financial information is presented, as the

acquisition was not material to the Company’s Consolidated Financial Statements.

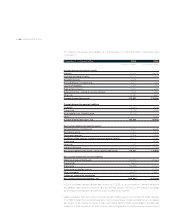

d) Cole National

On July 23, 2003, the Company formed an indirect wholly owned subsidiary Colorado Acquisition Corp.

for the purpose of acquiring all the outstanding common stock of Cole, a publicly traded company on

the New York Stock Exchange. On January 23, 2004, as amended as of June 2, 2004 and July 15, 2004,

the Company and Cole entered into a definitive merger agreement with the unanimous approval of the

Boards of Directors of both companies. On October 4, 2004, Cole became an indirect wholly owned

subsidiary of the Company. The aggregate consideration paid by the Company to former shareholders,

option holders and holders of restricted stock of Cole was approximately Euro 407.9 million (US$ 500.6

million). In connection with the merger, the Company assumed outstanding indebtedness with an

approximate aggregate fair value of the principal balance of Euro 253.2 million (US$ 310.8 million). The

acquisition was accounted for using the purchase method and, accordingly, the purchase price of Euro

423.7 million (US$ 520.1 million), including approximately Euro 15.8 million (US$ 19.5 million) of direct

acquisition-related expenses was allocated to the assets acquired and liabilities assumed based on

their fair value at the date of the acquisition. The Company used various methods to calculate the fair

value of the assets and liabilities and all valuations have been completed. The excess of purchase price

over net assets acquired (“goodwill”) has been recorded in the accompanying Consolidated Balance

Sheet. The acquisition of Cole National was made as result of the Company’s strategy to continue

expansion of its retail business in North America.