LensCrafters 2005 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.> 146 | ANNUAL REPORT 2005

Cole has guaranteed future minimum lease payments for certain store locations leased directly by

franchisees. These guarantees aggregated approximately Euro 7.3 million at December 31, 2005.

Performance under a guarantee by the Company is triggered by default of a franchisee on its lease

commitment. Generally, these guarantees also extend to payments of taxes and other expenses

payable under the leases, the amounts of which are not readily quantifiable. The terms of these

guarantees range from one to ten years. Many are limited to periods less than the full term of the lease

involved. Under the terms of the guarantees, Cole has the right to assume the primary obligation and

begin operating the store. In addition, as part of the franchise agreements, Cole may recover any

amounts paid under the guarantee from the defaulting franchisee. The Company has accrued a liability

at December 31, 2005 for the estimates of the fair value of the Company’s obligations from guarantees

entered into or modified after December 31, 2002, using an expected present value calculation. Such

amount is immaterial to the Consolidated Financial Statements as of December 31, 2004 and 2005.

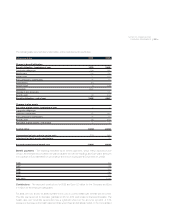

Credit facilities

As of December 31, 2004 and 2005 Luxottica Group had unused short-term lines of credit of

approximately Euro 365.8 million and Euro 457.2 million, respectively.

The Company and its wholly-owned Italian subsidiary Luxottica S.r.l. maintain unsecured lines of credit

with primary banks for an aggregate maximum credit of Euro 490.9 million. These lines of credit are

renewable annually, can be cancelled at short notice and have no commitment fees. At December 31,

2005, these credit lines were utilized for Euro 144.3 million.

US Holdings maintains four unsecured lines of credit with four separate banks for an aggregate

maximum credit of Euro 108.1 million (US$ 128 million). These lines of credit are renewable annually,

can be cancelled at short notice and have no commitment fees.

At December 31, 2005, there were no amounts outstanding and Euro 37.2 million in aggregate face

amount of standby letters of credit outstanding under these lines of credit (see below).

The blended average interest rate on these lines of credit is approximately LIBOR plus 0.25%.

Outstanding standby letters of credit

A U.S. subsidiary has obtained various standby letters of credit from banks that aggregated Euro 35.6

million and Euro 48 million as of December 31, 2004 and 2005, respectively. Most of these letters of

credit are used for security in risk management contracts or as security on store leases. Most contain

evergreen clauses under which the letter is automatically renewed unless the bank is notified not to

renew. Substantially all the fees associated with maintaining the letters of credit fall within the range of

60 to 80 basis points annually.

Litigation

In May and June 2001, certain former stockholders of Sunglass Hut International, (“SGHI”)

commenced actions in the U.S. District Court for the Eastern District of New York against the Company

and its acquisition subsidiary formed to acquire SGHI on behalf of a purported class of former SGHI

stockholders. These actions were subsequently consolidated into a single amended consolidated

class action complaint, which alleged, among other claims, that the defendants violated certain

provisions of U.S. securities laws and the rules thereunder, in connection with the acquisition of SGHI in

a tender offer and second-step merger. The plaintiffs’ principal claim was that certain payments to

James Hauslein, the former Chairman of SGHI, under a consulting, non-disclosure and non-