LensCrafters 2005 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 104 | ANNUAL REPORT 2005

2003 2004 2005 2005

(Euro/000) (US$/000) (1)

CASH FLOWS FROM OPERATING ACTIVITIES

Net income 267,343 286,874 342,294 405,345

ADJUSTMENTS TO RECONCILE

NET INCOME TO NET CASH PROVIDED

BY OPERATING ACTIVITIES:

Minority interest in income

of consolidated subsidiaries 5,122 8,614 9,253 10,957

Deferred stock-based compensation - - 22,711 26,894

Depreciation and amortization 134,840 152,751 194,205 229,978

(Benefit) provision for deferred income taxes 12,865 45,414 (90,104) (106,701)

Loss (gain) on disposals of fixed assets - net (124) 7,641 6,532 7,735

Unrealized foreign exchange (gain) - (13,445) - -

Termination indemnities matured

during the year - net 2,403 6,768 3,723 4,409

CHANGES IN OPERATING ASSETS AND LIABILITIES,

NET OF ACQUISITION OF BUSINESSES:

Accounts receivable 23,888 (15,819) (33,266) (39,394)

Prepaid expenses and other (43,556) 21,077 (56,773) (67,231)

Inventories 17,120 44,139 64,584 76,480

Accounts payable (45,029) 7,062 52,233 61,854

Accrued expenses and other (39,857) (22,365) (14,011) (16,592)

Accrual for customers' right of return (249) 727 (1,882) (2,229)

Income taxes payable (7,227) (760) 123,961 146,795

Total adjustments 60,196 241,804 281,166 332,955

Cash provided by operating activities 327,539 528,678 623,460 738,300

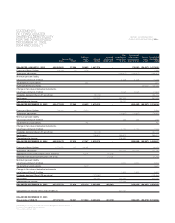

CASH FLOWS FROM INVESTING ACTIVITIES

Property, plant and equipment:

• Additions (81,288) (117,420) (229,416) (271,674)

• Disposals 3,839 198 1,082 1,281

Purchases of businesses net of cash acquired (342,432) (362,978) (86,966) (102,985)

Increase in investments (501) - - -

Sale of investment in Pearle Europe - - 144,000 170,525

Additions of intangible assets (48,177) (301) (4,479) (5,304)

Cash used in investing activities (468,559) (480,501) (175,779) (208,157)

STATEMENTS

OF CONSOLIDATED

CASH FLOWS

FOR YEARS ENDED

DECEMBER 31, 2003,

2004 AND 2005 (*)

(1) Translated for convenience at the New York City Noon Buying Rate as determined in Note 1.

See notes to Consolidated Financial Statements.

(*) In accordance with U.S. GAAP.