LensCrafters 2005 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

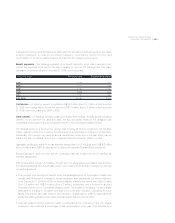

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 127 <

an immaterial amount was accrued for as a liability. Management believes no significant unaccrued

liabilities will arise from the related tax reviews.

The Company generally does not provide for an accrual for income taxes on undistributed earnings of

its foreign operations to the related Italian Parent Company that are intended to be permanently invested.

It is not practicable to determine the amount of income tax liability that would result had such earnings

actually been repatriated. In connection with the 2005 earnings of certain subsidiaries, the Company has

provided for an accrual for Italian income taxes related to declared dividends of earnings.

At December 31, 2005, US Holdings had restricted U.S. Federal net operating loss carryforwards of

approximately Euro 114.8 million (US$ 135.4 million), which may be used to offset income generated by

US Holdings or by any of its wholly owned subsidiaries. These losses begin to expire in 2019. With the

acquisition of Cole, the Company acquired approximately Euro 26.5 million (US$ 32.5 million) of

restricted U.S. Federal net operating loss carryforwards, of which approximately Euro 21.1 million (US$

25.8 million) were utilized in 2005. The utilization of a portion of the Cole loss carryforwards is limited due

to restrictions imposed by U.S. tax rules governing utilization of loss carryforwards following changes in

ownership. A portion of the Cole net operating loss carryforwards will expire each year going forward. In

fiscal 2004 and 2005, approximately Euro 1.8 million and zero, respectively, expired.

As of December 31, 2004 and 2005, the Company had recorded an aggregate valuation allowance of

Euro 22.8 million and Euro 15.0 million, respectively, against deferred tax assets recorded in connection

with net operating loss carryforwards because it is more likely than not that the above deferred income

tax assets will not be fully utilized in future periods.

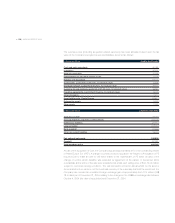

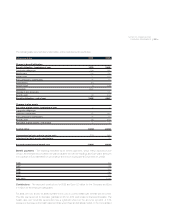

8. LONG-TERM DEBT

Long-term debt consisted of the following:

At December 31 - In thousands of Euro 2004 2005

Credit agreement with various Italian financial institutions (a) 450,000 275,000

UniCredito Italiano credit facility (b) 125,572 -

Senior unsecured guaranteed notes (c) 221,598 246,273

Credit agreement with various financial institutions (d) 851,890 974,338

Capital lease obligations, payable in installments through 2005 4,107 4,170

Other loans with banks and other third parties,

interest at various rates (from 3.14 to 19.96% per annum),

payable in installments through 2017. Certain subsidiaries’

fixed assets are pledged as collateral for such loans (e) 29,697 31,591

Total 1,682,864 1,531,372

Current maturities 405,369 111,323

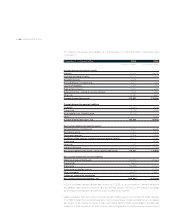

(a) In December 2002, the Company entered into an unsecured credit facility with Banca Intesa S.p.A.

The unsecured credit facility provided borrowing availability of up to Euro 650 million. This facility

included a term portion of Euro 500 million which required a balloon payment of Euro 200 million in

June 2004 and equal quarterly instalments of principal of Euro 50 million subsequent to that date.

Interest accrued on the term portion based on Euribor as defined in the agreement plus 0.45%. The

revolving portion provided borrowing availability of up to Euro 150 million. Amounts borrowed under the

revolving loan could be borrowed and repaid until final maturity. The final maturity of all outstanding

principal amounts and interest was December 27, 2005. In December 2005, the Company repaid in