LensCrafters 2005 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

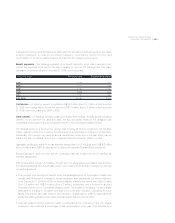

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 125 <

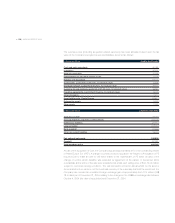

7. INCOME TAXES

Income before provision for income taxes and the provision for income taxes consisted of the following:

Year ended December 31 - In thousands of Euro 2003 2004 2005

Income before provision for income taxes

Italian companies 146,055 149,479 216,438

U.S. companies 192,732 235,551 262,310

Foreign companies 51,006 72,123 78,821

Total 389,793 457,153 557,569

Provision for income taxes

•Current

Italian companies 17,313 23,194 127,730

U.S. companies 74,113 65,356 127,540

Foreign companies 13,037 27,701 40,855

Total 104,463 116,251 296,125

•Deferred

Italian companies 14,174 9,017 (74,874)

U.S. companies 1,419 39,377 (14,295)

Foreign companies (2,728) (2,980) (934)

Total 12,865 45,414 (90,103)

Total 117,328 161,665 206,022

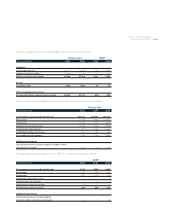

The Italian statutory tax rate is the result of two components: national (“IRES”) and regional (“IRAP”) tax.

IRAP could have a substantially different base for its computation than IRES.

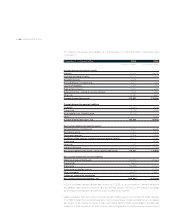

Reconciliation between the Italian statutory tax rate and the effective tax rate is as follows:

Year ended December 31 - In thousands of Euro 2003 2004 2005

Italian statutory tax rate 38.3% 37.3% 37.3%

Aggregate effect of different rates in foreign jurisdictions (1.9%) 0.5% 1.7%

Aggregate Italian tax benefit - net - - (4.1%)

Permanent differences, principally losses in subsidiary

companies funded through capital contributions,

net of non-deductible goodwill (6.3%) (2.4%) -

Aggregate other effects - - 2.1%

Effective rate 30.1% 35.4% 37.0%

The 2005 aggregate Italian tax benefit is caused by the Company complying with an Italian law that

allows for the step up in tax basis of certain intangible assets.

Beginning with fiscal year 2004, for income tax purposes, the Company and its Italian subsidiaries file

tax returns on a consolidated basis.