LensCrafters 2005 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 141 <

directly to shareholders’ equity. The principal cause of the deterioration of the funded status in the

pension liability in previous years was caused by negative returns from investments held in the

international equity markets in those years. As of December 31, 2004 and 2005, a decrease of Euro

0.2 million and a decrease of Euro 2.5 million, respectively, in the excess minimum liability, net of

income taxes, resulted in an increase of shareholders’ equity.

In September 2002, the Board of Directors authorized US Holdings to repurchase through the open

market up to 11,500,000 ADRs of Luxottica Group S.p.A., representing 2.5% of the authorized and

issue share capital, during an 18-month period starting in September 2002. In March 2003, the

Company announced that US Holdings had resolved to purchase up to an additional 10,000,000

ADRs of Luxottica Group S.p.A., representing 2.2% of the authorized and issued share capital of the

Company, over the 18-month period commencing on that date. As of December 31, 2004, both

repurchase programs expired and US Holdings has purchased 6,434,786 (1,911,700 in 2002 and

4,523,786 in 2003) ADRs at an aggregate purchase price of Euro 70.0 million (U.S. Dollar 73.8

million translated at the exchange rate at the time of the transaction). In connection with the

repurchase, an amount of Euro 70.0 million is classified as treasury shares in the Company’s

Consolidated Financial Statements.

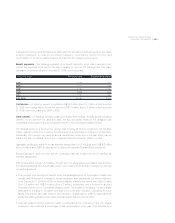

12. SEGMENTS AND RELATED INFORMATION

The Company adopted SFAS No. 131, Disclosures about segments of an enterprise and related

information, in 1998. The Company operates in two industry segments: (1) manufacturing and

wholesale distribution and (2) retail distribution. Through its manufacturing and wholesale distribution

operations, the Company is engaged in the design, manufacture, wholesale distribution and marketing

of house brand and designer lines of mid- to premium-priced prescription frames and sunglasses.

The Company operates in the retail segment through its retail division, consisting of LensCrafters,

Sunglass Hut International, OPSM and Cole National.

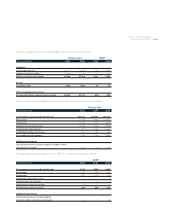

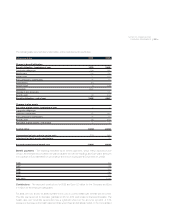

The following tables summarize the segmental and geographic information deemed essential by the

Company’s management for the purpose of evaluating the Company’s performance and for making

decisions about future allocations of resources.

The “Inter-segment transactions and corporate adjustments” column includes the elimination of inter-

segment activities which consist primarily of sales of product from the manufacturing and wholesale

segment to the retail segment and corporate related expenses not allocated to reportable segments.

This has the effect of increasing reportable operating profit for the manufacturing and wholesale and

retail segments. Identifiable assets are those tangible and intangible assets used in operations in each

segment. Corporate identifiable assets are principally cash, goodwill and trade names.