LensCrafters 2005 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 120 | ANNUAL REPORT 2005

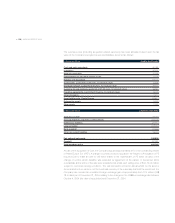

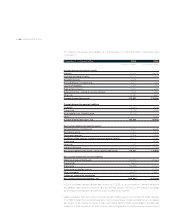

The purchase price (including acquisition-related expenses) has been allocated based upon the fair

value of the Company’s acquired assets and liabilities assumed as follows:

In thousands of Euro Assets purchased

Cash and cash equivalents 60,762

Inventories 95,601

Accounts receivable 45,446

Prepaid expenses and other current assets 12,456

Property and equipment 109,174

Trade names (useful lives of 25 years, no residual value) 72,909

Distributor network (useful life of 23 years, no residual value) 98,322

Customer list and contracts (useful life of 21-23 years, no residual value) 68,385

Franchise agreements (useful life of 20 years, no residual value) 18,413

Other intangibles 17,214

Asset held for sale - Pearle Europe 143,617

Deferred tax assets 74,949

Other assets 11,252

In thousands of Euro Liabilities assumed

Accounts payable (49,190)

Accrued expenses and other current liabilities (164,205)

Deferred tax liabilities (94,910)

Long-term debt (253,284)

Bank overdraft (22,668)

Other non current liabilities (78,425)

Fair value of net assets 165,818

Goodwill 257,922

Total purchase price 423,740

As part of the acquisition of Cole, the Company acquired approximately 21% of the outstanding shares

of Pearle Europe B.V. (“PE”). A change of control provision included in the Articles of Association of PE

required Cole to make an offer to sell these shares to the shareholders of PE within 30 days of the

change of control, which deadline was extended by agreement of the parties. In December 2004,

substantially all the terms of the sale were established at a final cash selling price of Euro 144.0 million,

subject to customary closing conditions. The sale transaction closed in January 2005. As the asset is

denominated in Euro, which is not the functional currency of the subsidiary that held the investment, the

Company has recorded an unrealized foreign exchange gain of approximately Euro 13.4 million (US$

18.4 million) as of December 31, 2004, relating to the changes in the US$/Euro exchange rate between

October 4, 2004 (the date of acquisition) and December 31, 2004.